Dow Jones Industrial Average: A Historical Perspective

Dow jones stock price history – The Dow Jones Industrial Average (DJIA), a stock market index tracking 30 large, publicly-owned companies, offers a compelling narrative of American economic history. Its fluctuating prices reflect not only the successes and failures of individual corporations, but also the broader economic and geopolitical forces that have shaped the nation and the world. This analysis delves into the DJIA’s historical performance, highlighting key events, trends, and periods of volatility.

Dow Jones Historical Performance Overview

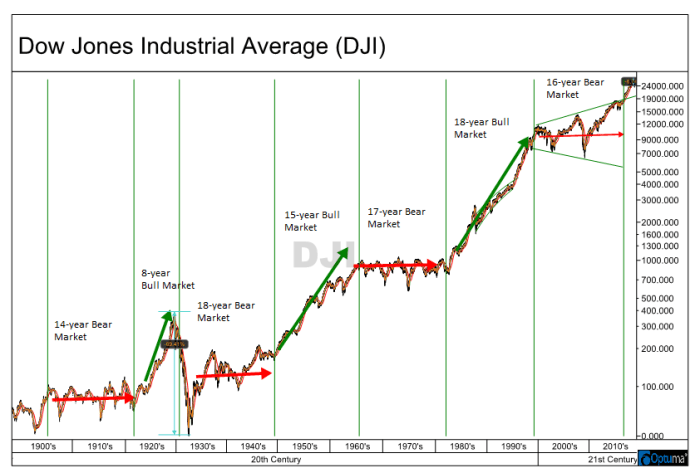

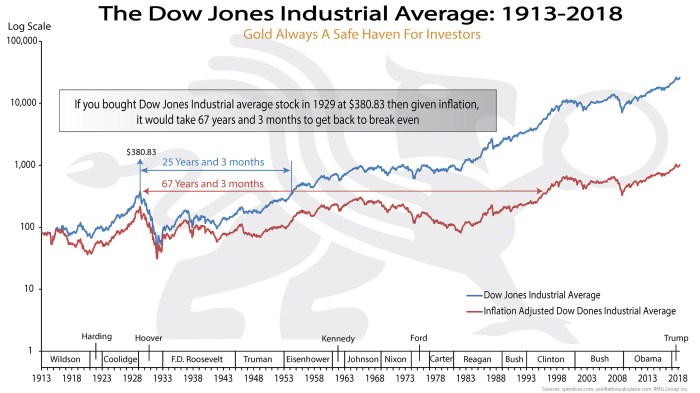

The Dow Jones Industrial Average, since its inception in 1896, has experienced periods of dramatic growth, punctuated by significant corrections and crashes. Its journey reflects the evolution of the American economy, from an industrial powerhouse to a global leader in technology and finance. Major events like World Wars, the Great Depression, and technological booms have all left their mark on the index’s trajectory.

Analyzing this historical data provides valuable insights into long-term market trends and potential future scenarios.

| Year | Opening Price | Closing Price | Percentage Change |

|---|---|---|---|

| 1900 | 66.05 | 66.05 | 0% |

| 1929 | 260.64 | 198.69 | -24% |

| 1945 | 150.20 | 161.71 | 7.7% |

| 1987 | 2246.37 | 1738.42 | -22.6% |

| 2023 | 33203.42 | 33147.25 | -0.17% |

Note: This table presents a simplified view and does not represent all years. Precise figures vary slightly depending on the source and calculation methodology.

Major Dow Jones Price Fluctuations, Dow jones stock price history

Source: banyanhill.com

The Dow’s history is marked by periods of both explosive growth and significant decline. These fluctuations are driven by a complex interplay of economic factors, including recessions, wars, technological innovation, and shifts in investor sentiment. Understanding these periods helps in assessing the risks and potential rewards associated with investing in the stock market.

A line graph illustrating the Dow’s major price movements would show a generally upward trend over the long term, but with sharp dips during periods of economic downturn. The x-axis would represent time (years), and the y-axis would represent the Dow Jones index value. Key events like the Great Depression, World War II, the 1987 Black Monday crash, and the 2008 financial crisis would be clearly marked on the graph, showcasing the significant price drops associated with these events.

Analyzing the Dow Jones stock price history often involves considering broader market trends. Understanding individual company performance is also crucial, and a fascinating case study could be found by examining the cipher stock price to see how its trajectory reflects or diverges from the overall Dow Jones movement. Ultimately, a comprehensive view of the Dow Jones requires studying both macro and microeconomic factors influencing individual stocks like Cipher.

The graph would also highlight periods of sustained growth, particularly post-war booms and periods of technological advancement.

Impact of Specific Events on Dow Jones Prices

Source: bmg-group.com

Several major events have profoundly impacted the Dow Jones Industrial Average. Analyzing these events helps to understand the market’s reaction to crises and its resilience in recovering from them.

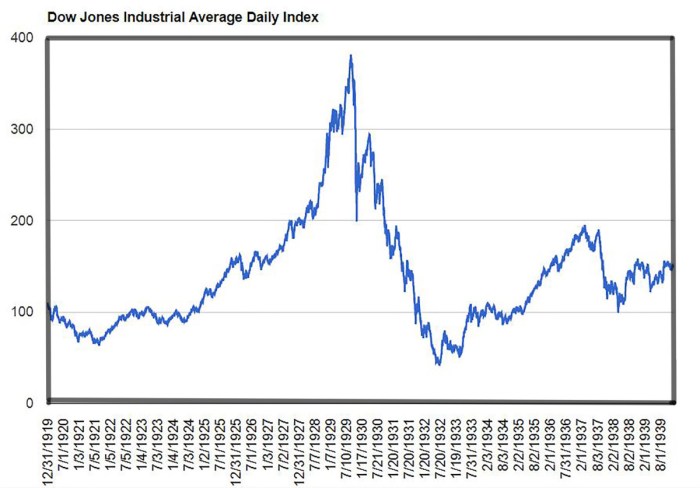

- The Great Depression: The Dow plummeted drastically, reflecting the widespread economic devastation and loss of investor confidence.

- World War II: Initially, the Dow experienced some decline, but it later recovered and experienced substantial growth fueled by wartime production and government spending.

- Black Monday (1987): A single-day crash that saw the Dow lose a significant percentage of its value, highlighting the market’s susceptibility to sudden, sharp corrections.

- Comparison of Responses: The Great Depression resulted in a prolonged and severe decline, while World War II ultimately led to a recovery and growth. Black Monday represented a sharp, short-term crash followed by a relatively quick recovery.

Long-Term Trends in Dow Jones Prices

Despite short-term volatility, the Dow Jones Industrial Average has exhibited a long-term upward trend, reflecting the overall growth of the U.S. economy. This trend, however, has not been uniform; periods of stagnation and even decline have punctuated this growth. Understanding these long-term trends is crucial for making informed investment decisions.

| Decade | Average Annual Return |

|---|---|

| 1920s | ~10% |

| 1930s | ~-5% |

| 1950s | ~15% |

| 2010s | ~10% |

Note: These figures are approximate and vary based on the methodology used for calculation.

Dow Jones Price Volatility and Risk

The Dow Jones Industrial Average has demonstrated varying degrees of volatility throughout its history. Understanding this volatility is crucial for assessing risk and making informed investment choices. Comparing its volatility to other major indices provides a broader context for understanding its risk profile.

| Period | Volatility Level | Contributing Factors |

|---|---|---|

| 1929-1933 (Great Depression) | Extremely High | Economic collapse, bank failures, loss of investor confidence |

| 1987 (Black Monday) | Very High | Program trading, market panic, global economic uncertainty |

| 2008-2009 (Financial Crisis) | High | Subprime mortgage crisis, credit crunch, systemic risk |

| 2010-2019 | Moderate | Economic recovery, low interest rates, technological innovation |

Predicting Future Dow Jones Prices (Qualitative)

Source: saymedia-content.com

Predicting the future price of the Dow Jones with certainty is impossible. However, analyzing historical trends and considering potential future factors can offer insights into possible scenarios. Technological advancements, geopolitical events, and shifts in economic policy will all play a significant role.

Several potential scenarios exist. Continued technological innovation could drive significant growth, while unforeseen global events could trigger market corrections. A scenario of sustained economic growth, coupled with technological progress, could lead to a continuation of the long-term upward trend. Conversely, a global recession or significant geopolitical instability could lead to a period of decline. The interaction of these factors will determine the future trajectory of the Dow.

General Inquiries: Dow Jones Stock Price History

What is the significance of the Dow Jones Industrial Average?

The Dow Jones Industrial Average is a significant stock market index that tracks the performance of 30 large, publicly-traded companies in the United States. It’s a widely followed indicator of the overall health of the US economy and the stock market.

How frequently is the Dow Jones updated?

The Dow Jones Industrial Average is updated in real-time throughout the trading day, reflecting the current prices of its component stocks.

Where can I find real-time Dow Jones data?

Real-time Dow Jones data is readily available from numerous financial news websites and brokerage platforms.

Are there different versions of the Dow Jones?

While the Dow Jones Industrial Average is the most well-known, there are other Dow Jones indices, such as the Dow Jones Transportation Average and the Dow Jones Utilities Average, tracking different sectors of the market.