Ford Stock Price Analysis: Current Stock Price For Ford

Source: thestreet.com

Current stock price for ford – This analysis explores the current and historical performance of Ford Motor Company’s stock price, examining influential factors and offering hypothetical scenarios to illustrate potential future price movements. Data sources used are assumed to be reliable financial information providers, and the analysis focuses on interpreting trends rather than providing financial advice.

Reliable Sources for Ford Stock Price Data

Real-time Ford stock price data can be obtained from several reputable sources. These include major financial data providers such as Yahoo Finance, Google Finance, Bloomberg, and dedicated financial news websites like the Wall Street Journal or Reuters. These platforms offer APIs (Application Programming Interfaces) or readily accessible data feeds that can be used for automated data retrieval.

Automated Stock Price Retrieval and Storage

A Python script, for example, could be designed to retrieve Ford’s stock price. It would utilize a chosen API (e.g., Yahoo Finance’s API) to fetch the current price. Error handling would involve implementing `try-except` blocks to catch potential errors like network issues or API rate limits. Upon successful retrieval, the price and timestamp would be stored in a database (e.g., SQLite or a cloud-based solution) for later analysis.

Example code snippet (illustrative, requires appropriate API keys and library installations):

#Illustrative Python code - Replace with actual API calls and error handlingtry: #Fetch data using API current_price = fetch_stock_price("F") # "F" is Ford's stock symbol timestamp = get_current_timestamp() store_data(current_price, timestamp) #Store in databaseexcept Exception as e: print(f"Error retrieving stock price: e")

Formatted Stock Price Data

A function to format the retrieved data could output a string like this: “Ford’s current stock price is $XXX.XX as of YYYY-MM-DD HH:MM:SS”. This ensures clear and consistent display of the information, including the precise time of data retrieval.

Ford Stock Price Performance Over the Past Year

Ford’s stock price over the past year has experienced volatility influenced by various factors. A detailed analysis would require specific date ranges and would vary depending on the actual market data.

- Significant High: (Insert actual data from reliable source, e.g., “$XX.XX on YYYY-MM-DD”)

- Significant Low: (Insert actual data from reliable source, e.g., “$XX.XX on YYYY-MM-DD”)

- Overall Trend: (Describe the overall trend – upward, downward, or sideways, with supporting data)

Impact of News and Economic Factors on Ford’s Stock Price

Source: capital.com

Major news events and economic conditions significantly influenced Ford’s stock performance during the past year. For instance, fluctuations in commodity prices (steel, aluminum), changes in interest rates affecting borrowing costs, and the overall state of the economy (recessionary pressures or growth) all played a role.

- Specific News Event Example: (e.g., “The announcement of a new electric vehicle model positively impacted investor sentiment, leading to a price increase.”)

- Economic Factor Example: (e.g., “Rising inflation and increased interest rates led to concerns about consumer spending and negatively impacted Ford’s stock price.”)

Comparison with Competitors

Source: arcpublishing.com

Comparing Ford’s performance to its competitors provides context for its stock price movements.

| Company | Highest Price (Past Year) | Lowest Price (Past Year) | Percentage Change |

|---|---|---|---|

| Ford | (Insert Data) | (Insert Data) | (Insert Data) |

| General Motors | (Insert Data) | (Insert Data) | (Insert Data) |

| Tesla | (Insert Data) | (Insert Data) | (Insert Data) |

Key Influencers of Ford’s Current Stock Price

Several factors contribute to Ford’s current stock valuation. These factors are interconnected and influence each other.

- Economic Indicators: Inflation rates, interest rates, and consumer confidence directly impact consumer spending on vehicles, affecting Ford’s sales and profitability.

- Company Announcements: New product launches, financial reports (earnings, revenue, etc.), and strategic partnerships influence investor perception and market sentiment.

- Investor Sentiment and Market Trends: Overall market conditions (bull or bear market), investor confidence in the automotive sector, and speculation about future performance all play a role.

Hypothetical Scenarios: Significant Stock Price Changes

To illustrate potential price movements, let’s consider hypothetical scenarios.

Significant Stock Price Increase

A significant increase in Ford’s stock price could result from a combination of factors. For example, the successful launch of a highly anticipated electric vehicle, coupled with strong quarterly earnings exceeding market expectations and positive reviews from automotive publications, could significantly boost investor confidence and drive up the stock price.

Significant Stock Price Decrease

Conversely, a significant decrease could be triggered by several factors:

- Negative news about a major product recall, leading to significant financial losses and reputational damage.

- A significant drop in sales due to economic downturn or increased competition.

- Unexpected negative financial results in quarterly earnings reports, revealing lower-than-expected profits or losses.

Conceptual Framework for Predictive Modeling

A hypothetical predictive model could incorporate various factors to forecast Ford’s stock price. This model would need to analyze historical stock data, economic indicators (inflation, interest rates, GDP growth), industry trends, competitor performance, and news sentiment analysis (using natural language processing techniques) to create a comprehensive predictive framework.

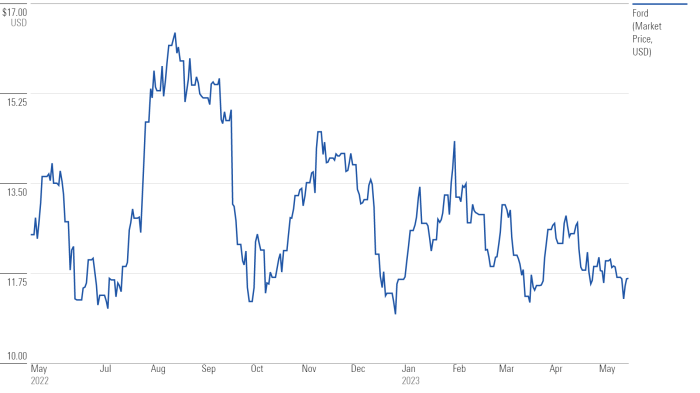

Visual Representation of Ford’s Stock Price, Current stock price for ford

A line graph visualizing Ford’s stock price over the past six months would show the price fluctuations over time. Key data points to include would be significant highs and lows, and the overall trend (upward, downward, or sideways). The graph would visually highlight periods of significant price volatility and periods of relative stability.

A bar chart comparing Ford’s current stock price to its average price over the past year and its hypothetical projected price would offer a clear visual comparison of these three key data points. This would allow for a quick assessment of the current stock price’s position relative to its historical average and future projections.

Keeping an eye on the current stock price for Ford is important for many investors. Understanding market fluctuations requires a broader perspective, and checking the bmy stock price today per share can offer valuable context for comparison. Ultimately, though, your investment strategy should focus on your individual goals and the long-term performance projections for Ford.

Answers to Common Questions

What are the main risks associated with investing in Ford stock?

Investing in Ford stock, like any stock, carries inherent risks. These include market volatility, competition within the automotive industry, economic downturns impacting consumer spending, and potential unforeseen events like supply chain disruptions or recalls.

Where can I find real-time Ford stock price updates?

Real-time Ford stock price updates are readily available through major financial websites such as Google Finance, Yahoo Finance, Bloomberg, and directly on the stock exchange’s website (e.g., NYSE).

How frequently does Ford release financial reports?

Ford typically releases quarterly and annual financial reports, providing details on its financial performance. The exact dates are announced in advance and are available on their investor relations website.