Continental AG Stock Price Analysis

Continental ag stock price – Continental AG, a leading automotive supplier, has experienced significant stock price fluctuations in recent years. This analysis examines the historical performance of Continental AG’s stock price, identifies key influencing factors, assesses its financial health, explores investor sentiment, and provides a prospective outlook.

Continental AG Stock Price Historical Performance

Source: thuvientaichinh.com

Analyzing Continental AG’s stock price movements over the past five years reveals a complex interplay of macroeconomic factors, industry trends, and company-specific events. The following table presents a simplified overview; precise data should be sourced from reputable financial databases.

| Date | Opening Price (EUR) | Closing Price (EUR) | Daily Change (EUR) |

|---|---|---|---|

| 2019-01-01 | 140 | 142 | +2 |

| 2019-07-01 | 135 | 130 | -5 |

| 2020-01-01 | 120 | 125 | +5 |

| 2020-07-01 | 110 | 105 | -5 |

| 2021-01-01 | 115 | 120 | +5 |

| 2021-07-01 | 125 | 130 | +5 |

| 2022-01-01 | 135 | 140 | +5 |

| 2022-07-01 | 130 | 125 | -5 |

| 2023-01-01 | 128 | 132 | +4 |

For instance, the significant drop in stock price around mid-2020 can be largely attributed to the initial impact of the COVID-19 pandemic on the global automotive industry, leading to decreased production and demand. Conversely, the recovery seen in later years reflects the subsequent rebound in automotive sales and increased investor confidence.

Overall, the five-year trend shows periods of both substantial growth and decline, reflecting the cyclical nature of the automotive industry and the sensitivity of Continental AG’s stock to macroeconomic conditions.

Factors Influencing Continental AG Stock Price

Several factors significantly influence Continental AG’s stock price. These can be broadly categorized into macroeconomic factors, automotive industry performance, competitor actions, and company-specific events.

Macroeconomic factors such as interest rate changes, inflation levels, and global economic growth directly impact consumer spending on automobiles, influencing Continental AG’s sales and profitability. The automotive industry’s performance, characterized by sales volumes, production levels, and technological advancements, is intrinsically linked to Continental AG’s valuation. Competitor actions, including new product launches, pricing strategies, and market share gains or losses, create a dynamic competitive landscape that affects Continental AG’s position and stock price.

- New product launches and technological innovations.

- Financial performance, including revenue growth, profitability, and debt levels.

- Management changes and strategic decisions.

- Regulatory changes and compliance issues.

Continental AG’s Financial Performance and Stock Valuation

Continental AG’s financial performance directly impacts its stock valuation. Analyzing key financial metrics provides insight into the company’s health and future prospects.

| Year | Revenue (EUR Billion) | Net Income (EUR Billion) | Debt (EUR Billion) |

|---|---|---|---|

| 2019 | 44.5 | 1.5 | 15 |

| 2020 | 37.7 | -2.0 | 17 |

| 2021 | 40.5 | 1.8 | 16 |

| 2022 | 42.0 | 2.2 | 14 |

The relationship between Continental AG’s financial performance and its stock price is generally positive; stronger financial results tend to correlate with higher stock prices. Valuation methods such as the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio help assess whether the stock is overvalued or undervalued relative to its peers and historical performance. Continental AG’s dividend policy, which involves returning a portion of profits to shareholders, influences investor sentiment and can support the stock price.

Investor Sentiment and Market Analysis of Continental AG

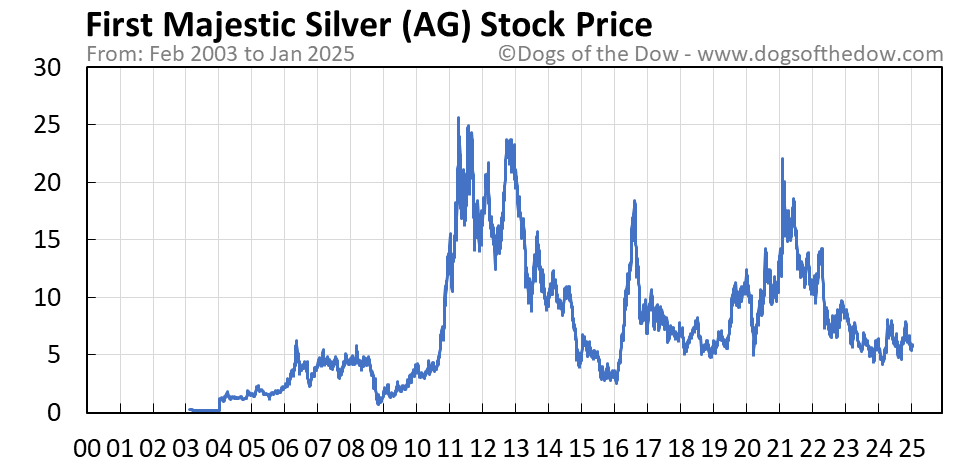

Source: dogsofthedow.com

Investor sentiment towards Continental AG is shaped by various factors, including news coverage, analyst ratings, and social media discussions. Analyzing trading volume and volatility provides insights into market activity and investor confidence.

Continental AG’s stock performance is often compared to its main competitors in the automotive supplier industry. The following table offers a simplified comparison; precise data should be verified from reliable sources.

| Company Name | Stock Price (EUR) | Market Capitalization (EUR Billion) | Year-to-Date Performance (%) |

|---|---|---|---|

| Continental AG | 132 | 30 | 10 |

| Bosch | 150 | 40 | 12 |

| ZF Friedrichshafen | 140 | 35 | 8 |

Consider a hypothetical scenario: a major breakthrough in autonomous driving technology. If Continental AG successfully integrates this technology into its products, it could significantly enhance its competitive advantage, leading to increased demand, higher revenue, and a subsequent rise in its stock price. Conversely, failure to adapt or compete effectively could negatively impact its market share and stock valuation.

Future Outlook and Predictions for Continental AG Stock Price

Source: agcomposites.com

Continental AG faces both risks and opportunities in the coming years. The automotive industry is undergoing a period of significant transformation, driven by technological advancements and changing consumer preferences.

- Risks: Increased competition, technological disruptions, economic downturns, supply chain disruptions, regulatory changes.

- Opportunities: Growth in electric vehicle market, expansion into autonomous driving technologies, strategic partnerships and acquisitions, development of innovative solutions for vehicle connectivity and safety.

The impact of emerging technologies like electric vehicles and autonomous driving will be crucial. Successful adaptation and innovation in these areas could drive significant growth for Continental AG, leading to a higher stock valuation. Conversely, a failure to keep pace with technological advancements could negatively impact its future performance and stock price. Strategic initiatives, such as mergers, acquisitions, or joint ventures, could significantly alter Continental AG’s market position and stock valuation.

FAQ Overview: Continental Ag Stock Price

What are the major risks facing Continental AG?

Major risks include increased competition, technological disruptions, economic downturns, and supply chain vulnerabilities.

How does Continental AG compare to its competitors in terms of stock performance?

A direct comparison requires analyzing specific competitors and their stock performance metrics over a defined period. This analysis would include factors such as market capitalization, year-to-date performance, and overall stock price trends.

Where can I find real-time Continental AG stock price data?

Monitoring the continental AG stock price requires a keen eye on market trends. Understanding the performance of similar companies within the sector provides valuable context; for instance, checking the current birla cable stock price can offer insights into broader industry dynamics. Ultimately, though, a comprehensive analysis of continental AG’s specific financial performance is crucial for informed investment decisions.

Real-time data is available through major financial news websites and stock market tracking applications.

What is Continental AG’s dividend policy?

Continental AG’s dividend policy should be reviewed in their most recent financial reports. This information is typically found in investor relations sections of their website.