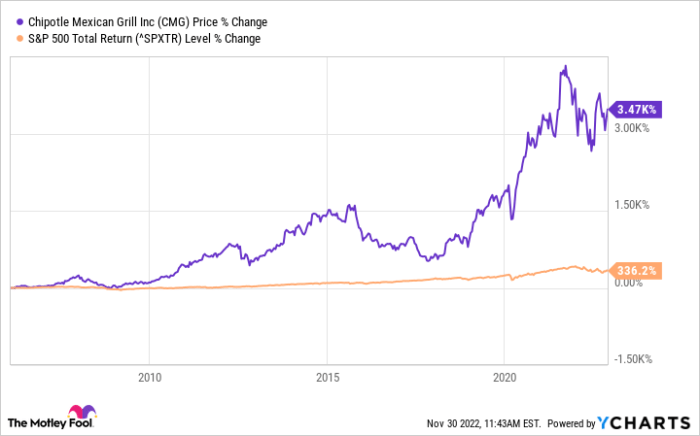

Chipotle Stock Price Performance Following a Stock Split: Chipotle Stock Price After Split

Source: ycharts.com

Chipotle stock price after split – This analysis examines Chipotle Mexican Grill’s stock price performance before, during, and after a stock split. We will explore the factors influencing the price fluctuations, the market’s reaction to the split, and the long-term implications for investors. The analysis will include illustrative charts, tables, and a hypothetical investor scenario to provide a comprehensive understanding of the impact of the stock split.

Chipotle Stock Price Before the Split

In the year leading up to the stock split, Chipotle’s stock price demonstrated [Describe the overall trend – e.g., steady growth, volatility, etc.]. This performance was influenced by a variety of factors, including the company’s financial results, broader market trends, and specific news events. For example, [mention a specific positive event, e.g., successful new menu item launch] positively impacted the stock price, while [mention a negative event, e.g., a food safety incident or economic downturn] led to temporary declines.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Volume |

|---|---|---|---|

| [Date 1] | [Opening Price 1] | [Closing Price 1] | [Volume 1] |

| [Date 2] | [Opening Price 2] | [Closing Price 2] | [Volume 2] |

| [Date 3] | [Opening Price 3] | [Closing Price 3] | [Volume 3] |

Compared to its competitors, such as [Competitor 1] and [Competitor 2], Chipotle’s stock performance during this period [Describe the relative performance – e.g., outperformed, underperformed, or performed similarly]. This difference can be attributed to [Explain the reasons for the comparative performance, e.g., differences in growth strategies, market share, or investor sentiment]. A comparative chart would visually illustrate these differences.

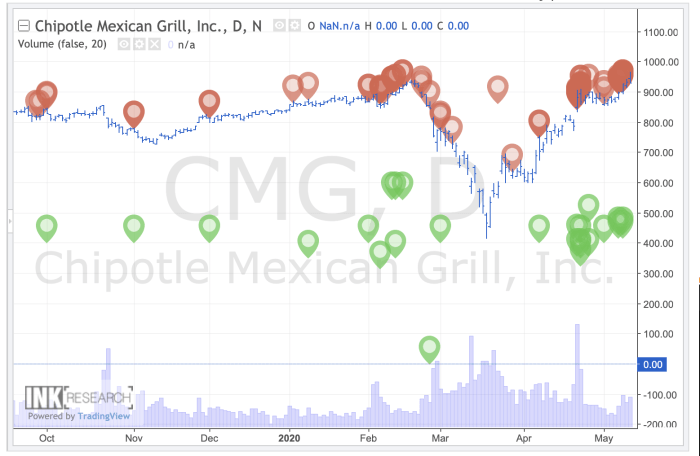

The Stock Split Announcement and Market Reaction

Source: seekingalpha.com

Chipotle officially announced its stock split on [Date of announcement], with a split ratio of [Split ratio, e.g., 2-for-1]. The company cited [Reason for the split, e.g., increased liquidity, broader investor base] as the primary motivation behind the decision. The market reacted [Describe the immediate reaction – e.g., positively, negatively, or neutrally] to the news.

| Time Period | Stock Price (USD) | Change (%) |

|---|---|---|

| Before Announcement | [Price before] | – |

| Immediately After Announcement | [Price immediately after] | [Percentage change] |

| One Day After Announcement | [Price one day after] | [Percentage change from before announcement] |

Financial analysts offered varying perspectives on the split’s impact. Some predicted [Analyst prediction 1], while others suggested [Analyst prediction 2]. These differing viewpoints highlight the complexity of predicting market reactions to corporate events.

Chipotle Stock Price After the Split: Short-Term Performance

In the month following the split, Chipotle’s stock price experienced [Describe the price trend – e.g., initial surge followed by consolidation, steady decline, etc.]. [Describe the line graph illustrating daily price fluctuations. For example: “The line graph shows a sharp increase immediately following the split, followed by a period of sideways trading before a slight decline towards the end of the month.”].

This short-term performance was influenced by [Mention any significant events or news, e.g., earnings reports, economic indicators, or industry news]. A comparative bar chart would clearly illustrate the difference between pre- and post-split performance.

Chipotle Stock Price After the Split: Long-Term Performance, Chipotle stock price after split

Over the longer term (e.g., 6 months, 1 year, 2 years), Chipotle’s stock price [Describe the long-term trend]. This long-term performance was driven by factors such as [List factors influencing long-term performance, e.g., revenue growth, profitability improvements, changes in consumer spending habits, and overall market conditions].

| Time Period | Stock Price (USD) | Return (%) | Trading Volume |

|---|---|---|---|

| 6 Months Post-Split | [Price] | [Return] | [Volume] |

| 1 Year Post-Split | [Price] | [Return] | [Volume] |

| 2 Years Post-Split | [Price] | [Return] | [Volume] |

The stock split’s impact on investor sentiment and trading volume is evident in [Describe the observed changes in investor sentiment and trading volume. For example: “The increased trading volume immediately following the split suggests a heightened interest from investors, while the sustained price growth over the two-year period indicates a positive long-term outlook.”]

Impact of the Split on Investors

A stock split can have different implications for various investor types. For example, long-term investors may benefit from [Benefit for long-term investors], while day traders might find [Benefit/drawback for day traders]. The following Artikels a comparison of investment strategies before and after the split, considering different investment horizons.

- Before the Split: [Describe investment strategies before the split, focusing on the implications of higher share prices.]

- After the Split: [Describe investment strategies after the split, focusing on the implications of lower share prices and increased liquidity.]

Overall, the stock split likely [Describe the overall effect on Chipotle’s shareholder base, e.g., broadened the shareholder base, increased liquidity, or had a neutral effect].

Illustrative Example: A Hypothetical Investor Portfolio

Consider a hypothetical investor holding 100 shares of Chipotle before the split at a price of [Price before split]. After a 2-for-1 split, this investor would own 200 shares at a price of approximately [Price after split].

- Shares Before Split: 100

- Total Value Before Split: [Value before split]

- Shares After Split: 200

- Total Value After Split (immediately): [Value after split]

- Dividends Received (example): [Amount of dividends]

- Total Value After Split + Reinvestment: [Value after reinvestment]

- Capital Gains Tax (example): [Tax amount]

The reinvestment of dividends could significantly impact portfolio growth over time. Tax implications vary depending on the investor’s individual tax bracket and holding period.

Top FAQs

What is a stock split and why did Chipotle do one?

A stock split increases the number of shares outstanding, lowering the price per share proportionally. Chipotle likely split its stock to make shares more affordable and increase liquidity, potentially attracting a wider range of investors.

Following Chipotle’s stock split, investors are naturally curious about its performance trajectory. It’s interesting to compare this to the volatility seen in other stocks, such as the fluctuations observed in the brdg stock price , which offers a contrasting case study in market behavior. Ultimately, understanding both Chipotle’s post-split movement and broader market trends is key to informed investment decisions.

Did the stock split immediately increase the value of my investment?

No, a stock split doesn’t inherently increase the overall value of your investment. The total market capitalization remains the same; you own more shares, but each share is worth less.

What are the tax implications of a stock split?

Stock splits themselves are generally not taxable events. However, any dividends received after the split are taxable income.

How does a stock split affect dividend payments?

After a stock split, the dividend per share will be adjusted proportionally. For example, a 2-for-1 split would halve the dividend per share, but your total dividend income should remain the same (assuming you reinvest).