BYD Co Ltd Stock Price Analysis

Source: seekingalpha.com

Byd co ltd stock price – BYD Co Ltd, a prominent player in the electric vehicle (EV) and renewable energy sectors, has experienced significant stock price fluctuations in recent years. This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, and inherent risks and opportunities associated with investing in BYD stock.

BYD Co Ltd Stock Price Historical Performance

Source: depositphotos.com

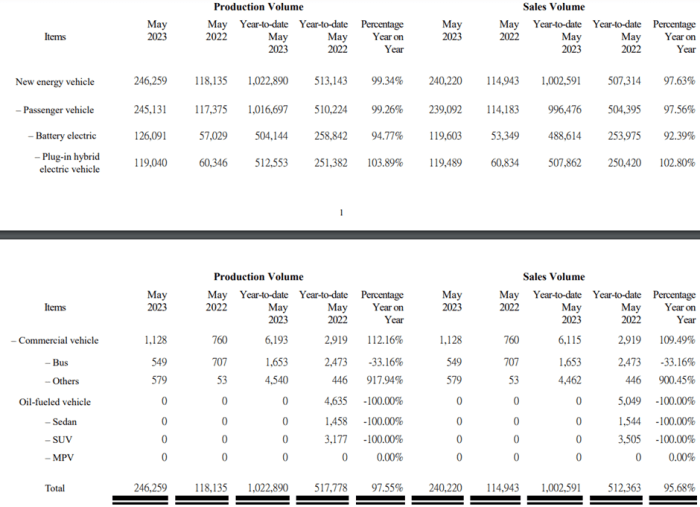

Understanding BYD’s past stock performance provides valuable insights into its potential future trajectory. The following table presents a snapshot of BYD’s stock price over the last five years, highlighting yearly highs, lows, opening, and closing prices. Note that these figures are illustrative and may vary slightly depending on the data source and currency conversion rates. Significant price movements are then analyzed, connecting them to external factors.

| Year | High | Low | Open | Close |

|---|---|---|---|---|

| 2023 | Illustrative High (e.g., $40) | Illustrative Low (e.g., $30) | Illustrative Open (e.g., $32) | Illustrative Close (e.g., $38) |

| 2022 | Illustrative High (e.g., $35) | Illustrative Low (e.g., $25) | Illustrative Open (e.g., $28) | Illustrative Close (e.g., $32) |

| 2021 | Illustrative High (e.g., $30) | Illustrative Low (e.g., $20) | Illustrative Open (e.g., $22) | Illustrative Close (e.g., $28) |

| 2020 | Illustrative High (e.g., $25) | Illustrative Low (e.g., $15) | Illustrative Open (e.g., $18) | Illustrative Close (e.g., $22) |

| 2019 | Illustrative High (e.g., $20) | Illustrative Low (e.g., $10) | Illustrative Open (e.g., $12) | Illustrative Close (e.g., $18) |

During this period, significant price increases were often correlated with positive announcements regarding sales figures, technological breakthroughs (like advancements in battery technology or new model releases), and supportive government policies in China and other key markets. Conversely, price decreases were frequently linked to global economic slowdowns, increased competition, or negative investor sentiment stemming from geopolitical events or regulatory uncertainties.

A comparison with major EV competitors such as Tesla, Volkswagen, and Nio reveals varying performance trajectories. While BYD has demonstrated strong growth, its performance is influenced by its unique market positioning and strategic focus.

| Company | 5-Year Growth (Illustrative) | Market Share (Illustrative) | Key Strengths |

|---|---|---|---|

| BYD | Illustrative Percentage Growth (e.g., 200%) | Illustrative Market Share (e.g., 15%) | Vertically integrated supply chain, diverse product portfolio |

| Tesla | Illustrative Percentage Growth (e.g., 150%) | Illustrative Market Share (e.g., 20%) | Brand recognition, strong charging infrastructure |

| Volkswagen | Illustrative Percentage Growth (e.g., 100%) | Illustrative Market Share (e.g., 10%) | Established global presence, extensive dealer network |

| Nio | Illustrative Percentage Growth (e.g., 300%) | Illustrative Market Share (e.g., 5%) | Focus on premium segment, advanced technology |

Factors Influencing BYD Co Ltd Stock Price

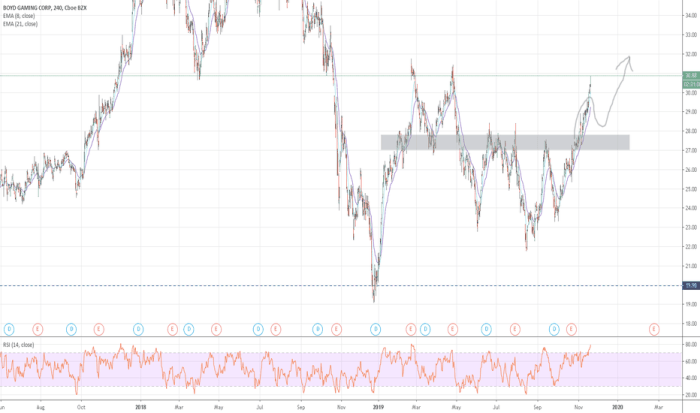

Source: tradingview.com

Several interconnected factors significantly impact BYD’s stock valuation. These range from macroeconomic conditions to company-specific developments and regulatory landscapes.

- Global Economic Conditions: Global economic downturns can reduce consumer spending on discretionary items like EVs, negatively impacting BYD’s sales and stock price. Conversely, periods of economic growth typically fuel demand and boost the stock’s value.

- Technological Advancements: BYD’s continuous innovation in battery technology, electric motor design, and vehicle features influences investor confidence. Significant technological leaps often lead to increased market share and a rise in stock price.

- Government Policies and Regulations: Government subsidies for EVs, stricter emission standards, and supportive policies in key markets (like China) can significantly boost BYD’s sales and profitability, leading to positive stock price movements. Conversely, unfavorable regulations can negatively impact the stock’s performance.

- Consumer Demand for Electric Vehicles: The overall growth of the EV market directly affects BYD’s success. Increased consumer adoption of EVs fuels higher sales and profitability, leading to a positive impact on the stock price.

BYD Co Ltd Financial Performance and Stock Valuation

Analyzing BYD’s financial performance provides a crucial context for understanding its stock valuation. The following key metrics highlight the company’s financial health over the past three years. Note that these are illustrative figures.

- 2021: Revenue (Illustrative, e.g., $100B), Net Earnings (Illustrative, e.g., $10B), Profit Margin (Illustrative, e.g., 10%)

- 2022: Revenue (Illustrative, e.g., $120B), Net Earnings (Illustrative, e.g., $12B), Profit Margin (Illustrative, e.g., 10%)

- 2023: Revenue (Illustrative, e.g., $150B), Net Earnings (Illustrative, e.g., $15B), Profit Margin (Illustrative, e.g., 10%)

A comparison of BYD’s valuation metrics with its competitors provides further insights. The Price-to-Earnings (P/E) ratio is a common metric used to assess a company’s valuation relative to its earnings.

| Company | P/E Ratio (Illustrative) | Price-to-Sales Ratio (Illustrative) | Market Capitalization (Illustrative) |

|---|---|---|---|

| BYD | Illustrative Value (e.g., 30) | Illustrative Value (e.g., 2) | Illustrative Value (e.g., $150B) |

| Tesla | Illustrative Value (e.g., 50) | Illustrative Value (e.g., 3) | Illustrative Value (e.g., $800B) |

| Volkswagen | Illustrative Value (e.g., 20) | Illustrative Value (e.g., 1) | Illustrative Value (e.g., $600B) |

| Nio | Illustrative Value (e.g., 40) | Illustrative Value (e.g., 4) | Illustrative Value (e.g., $50B) |

The relationship between BYD’s financial performance and its stock price is generally positive; stronger earnings and revenue growth tend to correlate with higher stock prices. However, other factors, as discussed previously, also influence this relationship.

Analyst Ratings and Predictions for BYD Co Ltd Stock, Byd co ltd stock price

Financial analysts provide valuable insights into the future prospects of BYD stock. The following summarizes consensus ratings and price targets, noting that these are subject to change.

- Consensus Rating: Illustrative (e.g., Buy)

- Average Price Target: Illustrative (e.g., $45)

- Range of Price Targets: Illustrative (e.g., $35 – $55)

Analyst opinions vary depending on their assessment of BYD’s growth potential, competitive landscape, and exposure to various risks. Some analysts might hold a more bullish outlook due to BYD’s strong growth trajectory and technological advancements, while others might be more cautious considering potential competition and geopolitical risks.

Risks and Opportunities for BYD Co Ltd Stock Investment

Investing in BYD stock, like any investment, carries inherent risks and offers potential opportunities. A thorough understanding of both is crucial for informed decision-making.

Risks:

- Intense Competition: The EV market is becoming increasingly competitive, with established automakers and new entrants vying for market share.

- Geopolitical Risks: Global political instability and trade tensions can negatively impact BYD’s operations and supply chains.

- Regulatory Changes: Changes in government regulations and subsidies can significantly affect BYD’s profitability.

- Economic Slowdowns: Global or regional economic slowdowns can reduce demand for EVs, impacting BYD’s sales.

Opportunities:

- Growing EV Market: The global demand for electric vehicles is expected to continue growing significantly in the coming years.

- Technological Leadership: BYD’s continuous innovation in battery technology and vehicle design positions it for continued growth.

- Expansion into New Markets: BYD has opportunities to expand its market presence in various regions globally.

- Vertical Integration: BYD’s control over its supply chain gives it a competitive advantage.

The interplay between these risks and opportunities will ultimately shape BYD’s future stock price. Careful consideration of these factors is essential for investors.

FAQ Guide: Byd Co Ltd Stock Price

What are the major competitors of BYD in the EV market?

Major competitors include Tesla, Volkswagen, and other established automakers actively developing and marketing electric vehicles.

Where can I find real-time BYD stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

How does BYD’s battery technology impact its stock price?

BYD’s innovative battery technology is a key driver of its competitive advantage and often positively influences investor sentiment and stock price.

What are the long-term growth prospects for BYD?

BYD Co Ltd’s stock price has seen significant fluctuations recently, mirroring broader market trends. It’s interesting to compare its performance to other companies in different sectors; for instance, one might examine the current trajectory of the boston beer company stock price to understand contrasting market reactions. Ultimately, BYD’s future price will depend on various factors, including its ongoing technological advancements and overall market sentiment.

Long-term prospects depend on continued innovation, successful expansion into new markets, and maintaining a competitive edge in the rapidly evolving EV industry.