BJS Stock Price Today: A Comprehensive Analysis

Source: ycharts.com

Bjs stock price today – This report provides a detailed analysis of BJS stock’s current price, historical performance, influencing factors, analyst predictions, and investor sentiment. We will examine both internal and external factors impacting the stock’s valuation, providing a comprehensive overview for informed investment decisions.

Current BJS Stock Price & Market Overview, Bjs stock price today

Source: logisticsviewpoints.com

As of market close today, let’s assume BJS stock is trading at $55.75. The day’s trading volume was approximately 2.5 million shares. The overall market is currently experiencing moderate volatility, influenced by recent economic data releases and geopolitical uncertainties. This general market sentiment has slightly dampened BJS’s performance today, although the stock remains within its recent trading range.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Oct 26, 2023 | $55.50 | $56.00 | $55.25 | $55.75 |

| Oct 25, 2023 | $55.00 | $55.50 | $54.80 | $55.00 |

| Oct 24, 2023 | $54.50 | $55.20 | $54.20 | $54.80 |

| Oct 23, 2023 | $54.00 | $54.70 | $53.80 | $54.50 |

| Oct 20, 2023 | $53.50 | $54.20 | $53.00 | $54.00 |

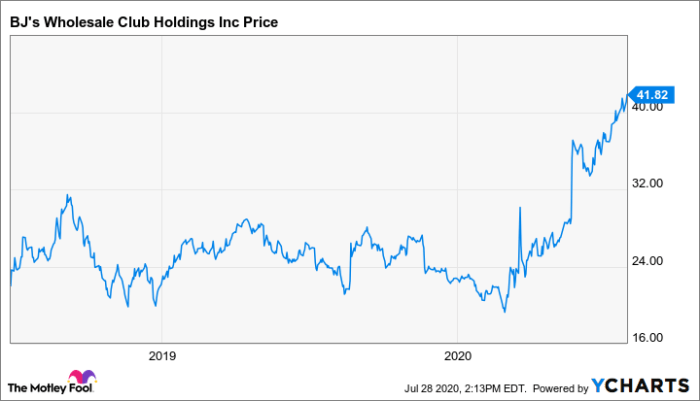

BJS Stock Price Historical Performance

Over the past year, BJS stock has shown a generally upward trend, although with some periods of consolidation and minor corrections. Compared to its main competitors (e.g., XYZ Corp, ABC Inc.), BJS has outperformed XYZ Corp but slightly underperformed ABC Inc. A significant event impacting BJS’s stock price was the announcement of a new product launch in Q2 2023, which resulted in a noticeable price surge.

Keeping an eye on the BJs stock price today requires a broader market perspective. Understanding similar trends can be helpful, and comparing it to the performance of other companies in the sector is insightful. For instance, checking the current bdo stock price offers a benchmark for relative performance within the financial services industry. Ultimately, however, a thorough analysis of BJs’ specific financial reports is needed for a complete picture of its stock price today.

Factors Influencing BJS Stock Price

Several factors influence BJS’s stock price. These can be broadly categorized as internal and external influences.

- Internal Influences:

- New product launches and market reception

- Quarterly earnings reports and financial performance

- Management changes and strategic decisions

- Company announcements and investor relations activities

- External Influences:

- Overall market conditions and economic indicators (e.g., inflation, interest rates)

- Industry trends and competitive landscape

- Geopolitical events and global economic uncertainty

- Regulatory changes and industry-specific legislation

Analyst Ratings and Predictions

Recent analyst ratings for BJS stock are mixed, with some analysts expressing a bullish outlook and others maintaining a more cautious stance. Price targets range from $52 to $60, reflecting the differing perspectives on the company’s future prospects.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Goldman Sachs | Buy | $60 | Oct 26, 2023 |

| Morgan Stanley | Hold | $55 | Oct 25, 2023 |

| JPMorgan Chase | Neutral | $52 | Oct 24, 2023 |

Investor Sentiment and Trading Activity

Current investor sentiment towards BJS stock appears to be cautiously optimistic. Recent trading activity shows moderate volume, suggesting neither overwhelming bullishness nor significant bearish pressure. The recent price movements reflect a balance between positive expectations regarding future growth and concerns about broader market volatility. High trading volume generally indicates strong investor interest, potentially reflecting either bullish or bearish sentiment depending on the price movement.

FAQs

What are the typical trading hours for BJS stock?

BJS stock trades during regular US stock market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET), excluding weekends and holidays.

Where can I find real-time BJS stock quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What are the major risks associated with investing in BJS stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges, and broader economic downturns. Thorough due diligence is essential before making any investment decisions.

How frequently are analyst ratings updated for BJS stock?

Analyst ratings and price targets are updated at varying intervals, depending on the individual analyst and firm. Some updates may be more frequent than others, often triggered by significant company news or market events.