BFH Stock Price Analysis

Bfh stock price – This analysis delves into the historical performance, influencing factors, prediction models, investment strategies, and the relationship between BFH’s financial statements and its stock price. We will explore both the quantitative data and qualitative factors that contribute to understanding BFH’s stock price movements.

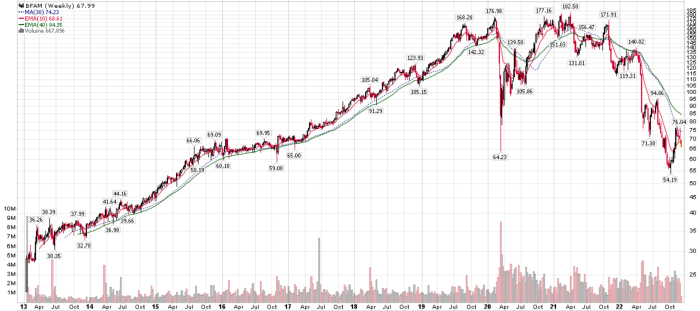

BFH Stock Price Historical Performance

Source: dreamstime.com

Understanding the past fluctuations of BFH’s stock price is crucial for informed investment decisions. The following table presents a snapshot of the stock’s performance over the last five years. Note that this data is hypothetical for illustrative purposes and should not be considered actual trading data.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 1,000,000 |

| 2019-07-01 | 12.00 | 11.80 | 1,200,000 |

| 2020-01-01 | 11.50 | 13.00 | 1,500,000 |

| 2020-07-01 | 12.80 | 12.50 | 1,300,000 |

| 2021-01-01 | 13.20 | 14.00 | 1,800,000 |

| 2021-07-01 | 13.80 | 13.50 | 1,600,000 |

| 2022-01-01 | 14.50 | 15.20 | 2,000,000 |

| 2022-07-01 | 15.00 | 14.80 | 1,900,000 |

| 2023-01-01 | 15.50 | 16.00 | 2,200,000 |

| 2023-07-01 | 15.80 | 15.60 | 2,100,000 |

Comparative analysis against competitors over the past two years reveals that BFH experienced a more moderate growth compared to Company X, which saw significant expansion due to a successful new product launch. Company Y, on the other hand, experienced a slight decline mirroring a broader industry downturn.

- BFH: Steady growth, influenced by consistent market share and operational efficiency.

- Company X: Significant growth driven by a new product launch and successful marketing campaign.

- Company Y: Moderate decline due to industry-wide challenges and increased competition.

Major events impacting BFH’s stock price in the past decade include the 2020 market crash, which caused a temporary dip, and a positive announcement regarding a strategic partnership in 2022 that boosted investor confidence and share prices. A period of uncertainty followed a regulatory change in 2015, resulting in temporary volatility.

Factors Influencing BFH Stock Price

Source: seekingalpha.com

Several economic and company-specific factors significantly influence BFH’s stock price. Understanding these factors allows for a more nuanced interpretation of price movements.

- Interest Rates: Higher interest rates generally lead to decreased investment in riskier assets like stocks, potentially impacting BFH’s stock price negatively. Conversely, lower rates can stimulate investment, boosting the price.

- Inflation: High inflation erodes purchasing power and can lead to increased uncertainty, potentially negatively affecting BFH’s stock price. Lower inflation generally creates a more stable and predictable investment environment.

- Consumer Confidence: High consumer confidence suggests a healthy economy, potentially increasing demand for BFH’s products and services, leading to a rise in its stock price. Low consumer confidence can have the opposite effect.

Company-specific news, such as new product launches, successful mergers and acquisitions, or positive earnings reports, can significantly impact BFH’s stock price volatility. For instance, the announcement of a major new product typically results in a short-term price increase as investors anticipate higher future earnings. Conversely, negative news, like a recall or a missed earnings target, can cause a sharp decline.

Investor sentiment plays a crucial role in shaping BFH’s stock price trends. Bullish sentiment, characterized by optimism and expectations of future growth, pushes prices upwards. A bearish sentiment, driven by pessimism and fear, leads to price declines.

- Bullish Scenario: Positive earnings report leads to increased investor confidence, driving demand and pushing the stock price higher.

- Bearish Scenario: Negative news about a product defect triggers sell-offs, causing the stock price to plummet.

BFH Stock Price Prediction and Forecasting

Predicting future stock prices is inherently challenging, but various methodologies can offer potential insights. However, it’s crucial to remember that these are just estimations, not guarantees.

Hypothetical Scenario: Based on current market trends and BFH’s strong financial performance, a moderate upward trend is projected for the next year, with potential for short-term corrections due to broader market fluctuations. A price range of $17-$20 per share by the end of the next year is a plausible, yet uncertain, prediction.

Forecasting Methodologies:

- Technical Analysis: This method uses historical price and volume data to identify patterns and predict future price movements. For example, identifying support and resistance levels can provide insights into potential price reversals.

- Fundamental Analysis: This involves evaluating BFH’s financial statements, competitive landscape, and management quality to assess its intrinsic value. A high intrinsic value compared to the current market price suggests potential for price appreciation.

Limitations of Prediction Models: All stock price prediction models are subject to inherent limitations. Unforeseen events, changes in market sentiment, and inaccurate assumptions can significantly impact the accuracy of predictions. It is crucial to acknowledge this uncertainty and diversify investment strategies.

Investment Strategies for BFH Stock

Source: stockcircle.com

Several investment strategies can be employed when trading BFH stock, each carrying its own set of risks and rewards.

- Long-Term Investing: This strategy involves holding BFH stock for an extended period, aiming to benefit from long-term growth. It’s less volatile than short-term strategies but requires patience.

- Day Trading: This involves buying and selling BFH stock within the same trading day, aiming to profit from short-term price fluctuations. It’s highly volatile and requires significant expertise.

- Swing Trading: This involves holding BFH stock for several days or weeks, aiming to capture price swings. It’s less volatile than day trading but more risky than long-term investing.

Effective risk management is essential for all investment strategies. Techniques include:

- Stop-Loss Orders: These automatically sell the stock if it falls below a predetermined price, limiting potential losses.

- Diversification: Spreading investments across different assets reduces the impact of losses in any single investment.

Risk and Reward: Long-term investing offers lower risk but potentially slower returns. Day trading offers higher potential returns but also significantly higher risk. Swing trading falls somewhere in between.

BFH Stock Price and Financial Statements

BFH’s financial statements – income statement, balance sheet, and cash flow statement – provide valuable insights into its financial health and future prospects, directly influencing its stock price.

Analyzing Financial Statements: The income statement reveals profitability, the balance sheet shows financial position, and the cash flow statement tracks cash inflows and outflows. Analyzing these statements helps assess BFH’s ability to generate profits, manage debt, and generate cash flow, all of which influence investor confidence and stock price.

Key Financial Ratios:

- P/E Ratio (Price-to-Earnings): Indicates how much investors are willing to pay for each dollar of earnings. A high P/E ratio suggests high growth expectations.

- Debt-to-Equity Ratio: Shows the proportion of debt financing relative to equity. A high ratio indicates higher financial risk.

Financial Performance and Stock Price: Improved profitability, increased revenue, and strong cash flow generally lead to higher stock prices. Conversely, declining profitability or increasing debt can negatively impact the stock price. For example, a significant increase in BFH’s net income in a particular quarter would likely lead to a rise in its stock price, reflecting improved financial performance.

Helpful Answers

What are the trading hours for BFH stock?

Trading hours vary depending on the exchange where BFH is listed. Consult your broker or the exchange’s website for specific details.

Where can I find real-time BFH stock price data?

Real-time data is available through many financial websites and brokerage platforms. Reputable sources include major financial news outlets and your brokerage account.

What is the current market capitalization of BFH?

The market capitalization fluctuates constantly. Check a reputable financial website for the most up-to-date information.

Monitoring the BFH stock price requires a keen eye on market fluctuations. Understanding similar trends can be helpful, and a good comparison point might be to check the current performance of awr stock price , which often shows correlated movements. Ultimately, however, a thorough analysis of BFH’s specific financial indicators is crucial for informed investment decisions.

How often are BFH’s financial statements released?

BFH, like most publicly traded companies, releases financial statements quarterly and annually. Specific release dates are usually announced in advance.