Understanding the “B” in Stock Price History: B Of A Stock Price History

B of a stock price history – The letter “B” in the context of stock price history can hold multiple meanings, depending heavily on the data source and its intended use. This ambiguity necessitates careful consideration of the context to ensure accurate interpretation. This article will explore the various interpretations of “B,” identify key data sources, and demonstrate how to analyze and utilize this data for trend identification and informed trading decisions.

Interpretations of “B” in Stock Price Data

The meaning of “B” is highly context-dependent. It could represent the bid price, indicating the highest price a buyer is willing to pay for a stock at a given time. Alternatively, it might refer to the number of buy orders, signifying the buying pressure on the stock. In some advanced analytics, “B” could even stand for beta, a measure of a stock’s volatility relative to the overall market.

Financial data providers often use their own internal codes, where “B” might represent a specific data point unique to their system. Therefore, understanding the specific data source and its documentation is paramount.

Data Sources for “B” in Stock Price History, B of a stock price history

Several data sources provide information relevant to different interpretations of “B”. Reliability and accuracy vary significantly depending on the source.

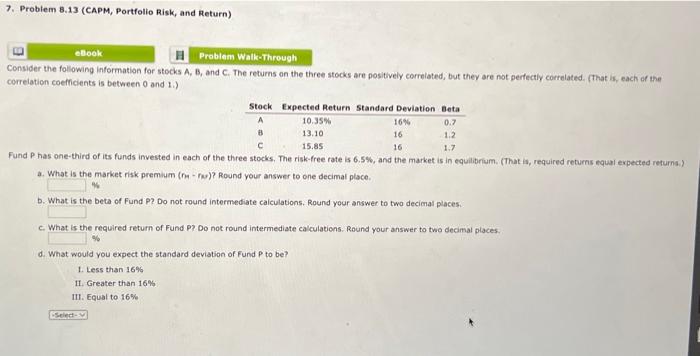

| Data Source | Data Frequency | Cost | Data Format |

|---|---|---|---|

| Brokerage Platforms (e.g., Interactive Brokers, TD Ameritrade) | Real-time or near real-time, depending on the platform and subscription | Varies widely based on features and subscription level; can range from free (limited data) to thousands of dollars per year for professional-grade access | Typically displayed directly on the platform’s interface, often downloadable in CSV or other formats |

| Financial Data Providers (e.g., Refinitiv, Bloomberg) | Real-time and historical data; frequency varies based on data type and subscription | High cost, often requiring significant subscriptions for comprehensive access | Structured data formats like XML, JSON, or proprietary formats; often requires specialized software for analysis |

| Publicly Available Databases (e.g., Yahoo Finance, Google Finance) | Generally delayed data, often end-of-day or intraday with some delay | Usually free | Often presented in readily consumable formats like CSV or through APIs |

Visualizing “B” Data and Trend Identification

Visualizing “B” data over time is crucial for identifying trends. Simple line charts can effectively display the bid price (“B” interpreted as bid) over time, allowing for visual identification of price movements. Moving averages, such as simple moving averages (SMA) or exponential moving averages (EMA), can smooth out short-term fluctuations and reveal underlying trends. For instance, a 20-day SMA of the bid price can help filter out daily noise and highlight longer-term trends.

Bollinger Bands, a technical indicator, can be used with “B” data (interpreted as bid price) to identify potential overbought or oversold conditions. Bollinger Bands consist of a moving average and two standard deviation bands above and below the average. A bid price consistently touching the upper band might suggest an overbought condition, while a consistently low bid price near the lower band might indicate an oversold condition.

The procedure involves calculating the moving average and standard deviations of the bid price data, plotting the bands, and interpreting the price’s position relative to the bands.

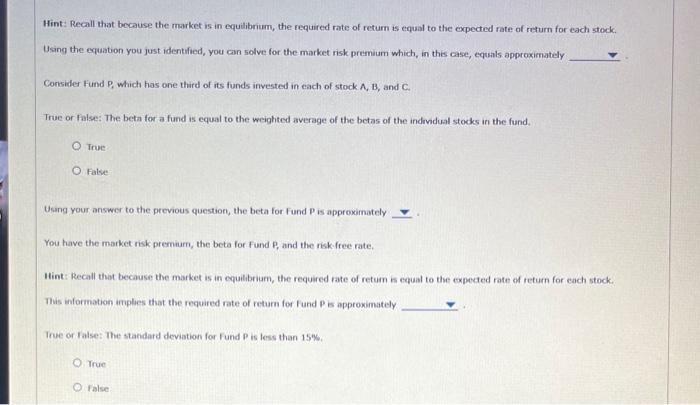

Relationship between “B” and Other Stock Metrics

Source: cheggcdn.com

Understanding the relationship between “B” (e.g., bid price) and other stock metrics is vital for comprehensive analysis. A strong correlation between high bid prices and high trading volume often indicates significant buying pressure. Conversely, low bid prices coupled with low volume might suggest a lack of interest.

- Bid Price and Volume: High bid prices with high volume often indicate strong buying pressure.

- Bid Price and Price: The bid price usually trails the last traded price, reflecting the current market sentiment.

- Bid-Ask Spread: A wide bid-ask spread can indicate low liquidity or market uncertainty.

Illustrative Examples of “B” in Action

Source: cheggcdn.com

Let’s consider three scenarios where “B” data plays a crucial role in trading decisions. Note that these are simplified examples for illustrative purposes and real-world trading requires more sophisticated analysis.

- Scenario 1: Breakout Trading: A stock’s bid price consistently tests a resistance level (e.g., a previous high). A significant increase in volume accompanies a break above this resistance, suggesting strong buying pressure. This could signal a potential breakout, prompting a long position.

- Scenario 2: Value Investing: A stock’s bid price is significantly below its intrinsic value, as determined through fundamental analysis. This discrepancy, coupled with a relatively low trading volume, might indicate an undervalued asset, prompting a long-term investment strategy.

- Scenario 3: Arbitrage: A stock trades at different prices on different exchanges. By comparing the bid prices across exchanges, a trader can identify arbitrage opportunities, buying low on one exchange and selling high on another.

Limitations and Considerations of “B” Data

While “B” data offers valuable insights, limitations exist. Data manipulation is possible, especially in less regulated markets. Market conditions and external factors (economic news, geopolitical events) significantly influence stock prices and should be considered when interpreting “B” data. Furthermore, the specific definition of “B” varies across data sources, requiring careful attention to data definitions and context.

Answers to Common Questions

What are some examples of less common interpretations of “B” in stock market data?

While bid price and buy orders are common, “B” could also represent, depending on the context, brokerage codes, specific block trades, or even internal data points used by some financial institutions. Always check the data source’s documentation for precise definitions.

How can I access real-time “B” data?

Real-time “B” data, specifically bid prices, is often available through professional-grade trading platforms and data vendors that charge subscription fees. Free sources usually provide delayed data.

What are the ethical considerations related to using “B” data?

Using “B” data ethically involves respecting data privacy regulations and avoiding any manipulative practices. Misrepresenting or misusing “B” data can lead to legal and reputational risks.