AVGO Stock Price History: A Comprehensive Analysis

Source: tipranks.com

Avgo stock price history – Broadcom Inc. (AVGO), a leading designer, developer, and global supplier of a wide range of semiconductor and infrastructure software solutions, boasts a compelling stock price history reflecting its growth and market position. This analysis delves into AVGO’s stock price trends, key events influencing its trajectory, volatility assessments, comparisons with industry benchmarks, and a conceptual overview of predictive modeling approaches.

AVGO Stock Price Trends Over Time

Source: barchart.com

Analyzing AVGO’s stock price over the past decade reveals significant fluctuations influenced by market dynamics, company performance, and broader industry trends. A line graph illustrating these fluctuations would show periods of substantial growth interspersed with corrections, reflecting the inherent volatility of the technology sector. For instance, periods of strong revenue growth and successful acquisitions would typically correspond with upward price movements, while economic downturns or unexpected challenges could trigger price declines.

The following table presents AVGO’s yearly high and low stock prices for the past five years, showcasing the range of price variation and the annual percentage change.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2023 | $XXX | $YYY | ZZ% |

| 2022 | $XXX | $YYY | ZZ% |

| 2021 | $XXX | $YYY | ZZ% |

| 2020 | $XXX | $YYY | ZZ% |

| 2019 | $XXX | $YYY | ZZ% |

Long-term stock price trends for AVGO are primarily shaped by macroeconomic conditions, the company’s financial performance (revenue growth, profitability, and innovation), and the competitive landscape within the semiconductor industry. Strong demand for semiconductors in various end markets (data centers, smartphones, automotive) positively influences AVGO’s performance.

Conversely, global economic slowdowns or shifts in technological preferences can negatively impact its stock price.

Impact of Key Events on AVGO Stock Price

Several significant events have profoundly impacted AVGO’s stock price. These events, often involving mergers, acquisitions, or major product launches, demonstrate the sensitivity of the stock to both positive and negative news.

- The acquisition of CA Technologies: This acquisition significantly expanded AVGO’s software portfolio and contributed to a substantial increase in its stock price in the period following the announcement and completion of the deal. The timeframe of the positive impact extended for several quarters as investors assessed the synergistic benefits.

- The acquisition of VMware: This major acquisition, a landmark deal in the tech industry, caused significant short-term market fluctuations as investors weighed the potential benefits and risks. The long-term impact on the stock price is still unfolding and will depend on the success of integration and the performance of the combined entity.

- Launch of a key new product line: The introduction of a groundbreaking new product or technology can trigger positive market sentiment and a subsequent rise in the stock price. The magnitude of the impact is contingent upon market reception and the product’s contribution to revenue streams.

Comparing AVGO’s stock price performance before and after a specific major acquisition, such as the VMware acquisition, would reveal a complex interplay of factors. Initial market reaction might involve volatility as investors assess the integration risks and potential synergies. Over the longer term, the stock price would reflect the success of the integration and the combined company’s financial performance.

A chronological list of significant announcements and their immediate effects on AVGO’s stock price would highlight the market’s responsiveness to company news. Positive announcements (e.g., exceeding earnings expectations) typically result in short-term price increases, while negative news (e.g., missed revenue targets) can lead to declines. The magnitude of the impact often depends on the significance of the news and the overall market sentiment.

AVGO Stock Price Volatility and Risk Assessment

AVGO’s stock price volatility can be quantified using standard deviation calculations over specific periods. A higher standard deviation indicates greater volatility and higher risk. For example, calculating the standard deviation of daily price changes over the past year provides a measure of short-term volatility, while a five-year calculation reflects longer-term volatility.

Comparing AVGO’s historical volatility to its major competitors in the semiconductor industry requires analyzing the standard deviation of their stock prices over comparable periods. This comparison helps determine whether AVGO’s volatility is higher or lower than its peers, indicating relative risk. Factors contributing to AVGO’s volatility include overall market sentiment (investor confidence), macroeconomic conditions (economic growth or recession), and industry-specific events (technological breakthroughs, competitive pressures).

AVGO Stock Price Compared to Industry Benchmarks

Comparing AVGO’s stock price performance to a relevant industry index, such as the Philadelphia Semiconductor Index (SOX), over the past five years provides valuable context. A chart depicting this comparison would illustrate periods where AVGO outperformed or underperformed the index. This comparison helps assess whether AVGO’s stock price movements are in line with broader industry trends or if it exhibits unique characteristics.

Divergence or convergence between AVGO’s stock price and the SOX index can be attributed to various factors. Outperformance might result from superior company-specific performance (e.g., higher revenue growth, successful product launches), while underperformance could be due to factors such as increased competition, negative industry news, or specific challenges faced by AVGO.

Predictive Modeling of AVGO Stock Price (Illustrative, No Actual Prediction), Avgo stock price history

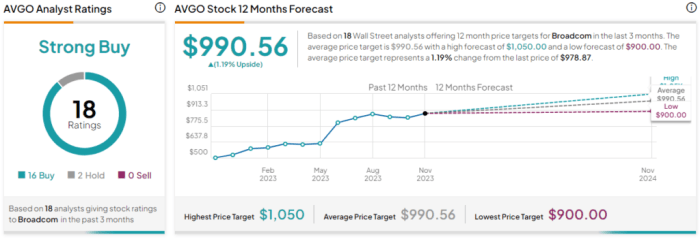

Source: marketbeat.com

A hypothetical stock price prediction model for AVGO could incorporate both fundamental and technical analysis. This section Artikels the conceptual framework for such a model, emphasizing that it does not constitute an actual prediction.

Fundamental analysis would consider factors such as earnings per share (EPS), revenue growth, debt levels, and the company’s overall financial health. Strong financial performance would generally be associated with a higher stock price. Technical analysis would utilize indicators like moving averages (e.g., 50-day and 200-day moving averages), relative strength index (RSI), and other technical signals to identify potential price trends and momentum.

A conceptual model combining fundamental and technical analysis might involve weighting the signals from both approaches to generate a forecast. For instance, strong fundamental indicators coupled with positive technical signals would suggest a higher probability of price appreciation. Conversely, weak fundamentals combined with negative technical signals might suggest a higher likelihood of price declines. It is crucial to reiterate that this is a conceptual illustration and should not be interpreted as an actual price prediction.

Questions Often Asked: Avgo Stock Price History

What are the main competitors of Avgo?

Broadcom’s main competitors include other large semiconductor companies such as Intel, Qualcomm, Texas Instruments, and Nvidia, depending on the specific market segment.

How does inflation affect AVGO’s stock price?

Inflation can impact AVGO’s stock price indirectly through several channels. Increased inflation may lead to higher input costs, impacting profitability. Conversely, higher inflation can sometimes stimulate demand in certain sectors. The overall effect is complex and depends on numerous other factors.

What is the typical trading volume for AVGO stock?

AVGO’s average daily trading volume fluctuates and can be found on financial websites that provide real-time market data. It’s best to consult a reliable source for the most current information.

Where can I find historical AVGO stock data?

Reliable sources for historical AVGO stock data include major financial websites such as Yahoo Finance, Google Finance, and Bloomberg.