Understanding Stock Prices: Define Stock Price

Define stock price – Stock prices, the fluctuating values of company shares, are a complex interplay of numerous factors. Understanding these influences is crucial for investors seeking to make informed decisions. This article delves into the key elements that shape stock prices, from fundamental company performance to broader market dynamics and external events.

Fundamental Factors Influencing Stock Price

A company’s intrinsic value, ultimately reflected in its stock price, is significantly influenced by its financial health and market position. Several key fundamental factors play a crucial role.

Impact of Earnings on Stock Price

A company’s earnings, representing its profitability, directly impact investor sentiment and stock price. Stronger-than-expected earnings typically lead to increased investor confidence and a rise in stock price, while disappointing earnings often result in price declines. For example, a tech company exceeding projected earnings by a significant margin might see its stock price jump substantially, reflecting positive investor reaction to the superior performance.

Debt-to-Equity Ratio’s Influence on Stock Valuation

The debt-to-equity ratio, indicating a company’s financial leverage, is a key metric for assessing risk. A high debt-to-equity ratio suggests higher financial risk, potentially deterring investors and leading to lower stock valuations. Conversely, a lower ratio often signifies financial stability and increased investor confidence, potentially driving up stock prices. For instance, a company with a high debt load might face challenges in securing further funding and might see its stock price negatively impacted.

Industry Trends and Stock Prices

Source: cheggcdn.com

Changes in industry trends can significantly influence stock prices. Emerging technologies, shifting consumer preferences, and regulatory changes can all create opportunities or challenges for companies within an industry, affecting their stock valuations. For example, the rise of electric vehicles has significantly impacted the automotive industry, with established automakers adjusting their strategies and experiencing stock price fluctuations as a result.

Comparative Influence of Fundamental Factors on Stock Price

| Factor | Positive Impact on Stock Price | Negative Impact on Stock Price | Example |

|---|---|---|---|

| Revenue Growth | Increased investor confidence, higher future earnings expectations | Slowing revenue growth, declining sales | A company consistently exceeding revenue projections typically sees its stock price appreciate. |

| Profitability (Net Income) | Higher returns for investors, increased dividend potential | Decreased profitability, losses | Companies demonstrating strong and consistent profitability tend to attract investors. |

| Market Share | Dominant market position, pricing power, higher profitability | Loss of market share to competitors, reduced pricing power | A company gaining market share often sees a positive impact on its stock valuation. |

Supply and Demand Dynamics in Stock Price Determination

Stock prices are fundamentally determined by the interaction of supply and demand in the market. The forces of buyers and sellers, influenced by various factors, create a dynamic equilibrium that shapes price fluctuations.

Buyer-Seller Interaction and Stock Prices

When demand for a stock exceeds supply (more buyers than sellers), the price tends to rise. Conversely, when supply outweighs demand (more sellers than buyers), the price typically falls. This basic principle of economics underpins the daily fluctuations in stock prices.

Market Sentiment and Price Fluctuations

Market sentiment, the overall feeling or attitude of investors towards a particular stock or the market as a whole, plays a significant role in driving price fluctuations. Positive sentiment, fueled by optimism and confidence, often leads to price increases, while negative sentiment, driven by fear and uncertainty, can cause price declines. News reports, analyst ratings, and economic data releases all influence market sentiment.

Events Shifting Supply and Demand

Significant news announcements, such as earnings reports, mergers and acquisitions, or regulatory changes, can dramatically shift the balance of supply and demand. For example, a positive earnings surprise can lead to a surge in buying pressure, driving the stock price upward. Conversely, negative news, such as a product recall or a lawsuit, can trigger a sell-off, causing the price to fall.

Supply, Demand, and Stock Price Relationship

Imagine a simple graph. The horizontal axis represents the quantity of shares, and the vertical axis represents the price. The demand curve slopes downward (higher price, lower demand), and the supply curve slopes upward (higher price, higher supply). The point where these two curves intersect determines the equilibrium price – the market-clearing price at which the quantity demanded equals the quantity supplied.

Shifts in either the supply or demand curve, caused by various factors, will lead to a new equilibrium price.

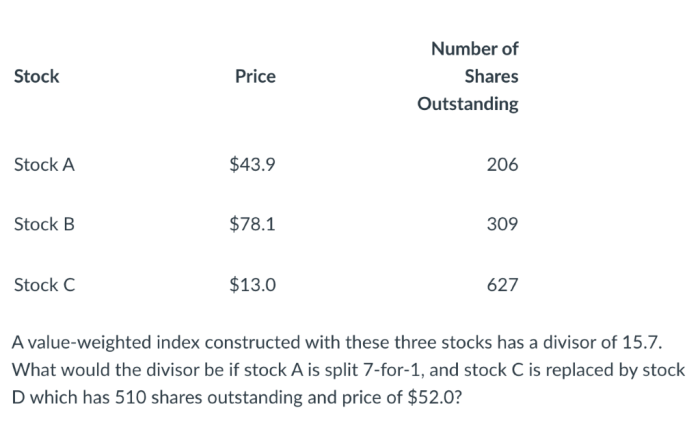

The Role of Market Indices and Benchmarks

Market indices provide a benchmark against which individual stock performance can be compared, offering a broader perspective on market trends and providing context for stock price movements.

Stock Performance vs. Market Index

Comparing a specific stock’s performance against a relevant market index, such as the S&P 500 or the Dow Jones Industrial Average, helps determine whether the stock is outperforming or underperforming the broader market. For example, if a tech stock significantly outperforms the Nasdaq Composite index, it indicates strong relative performance.

Influences on Market Indices and Impact on Individual Stocks

Major market indices are influenced by a multitude of factors, including overall economic conditions, investor sentiment, geopolitical events, and interest rate changes. These factors influence the overall market direction and, consequently, the prices of individual stocks within those indices. A strong economy generally leads to higher index values, which can positively impact most individual stock prices.

Market Indices and Stock Price Context

Different market indices provide varying perspectives on market performance. For instance, the S&P 500 represents a broad range of large-cap U.S. companies, while the Nasdaq Composite focuses on technology stocks. Analyzing a stock’s performance relative to several relevant indices provides a more comprehensive understanding of its price movements.

List of Market Indices and Characteristics

- S&P 500: A market-capitalization-weighted index of 500 large-cap U.S. companies.

- Dow Jones Industrial Average: A price-weighted average of 30 large, publicly-owned U.S. corporations.

- Nasdaq Composite: A market-capitalization-weighted index of over 3,000 companies, heavily weighted towards technology.

- Russell 2000: A small-cap stock market index comprising 2,000 of the smallest publicly traded companies in the U.S.

Valuation Methods for Determining Intrinsic Stock Value

Various methods exist for estimating a stock’s intrinsic value – its true worth based on fundamental analysis. These methods help investors determine whether a stock is undervalued or overvalued.

Discounted Cash Flow (DCF) Method

The DCF method estimates a stock’s value by discounting its projected future cash flows back to their present value. This method requires forecasting future cash flows, which involves inherent uncertainty, but it provides a theoretically sound approach to valuation. The formula involves discounting each year’s projected free cash flow by a discount rate reflecting the risk involved, then summing the present values to arrive at an estimate of the company’s intrinsic value.

Price-to-Earnings (P/E) Ratio

The P/E ratio is a widely used valuation metric that compares a company’s stock price to its earnings per share (EPS). A high P/E ratio might suggest that a stock is overvalued, while a low P/E ratio might indicate undervaluation. However, the P/E ratio should be interpreted in the context of industry averages and the company’s growth prospects.

Other Valuation Methods

Source: cheggcdn.com

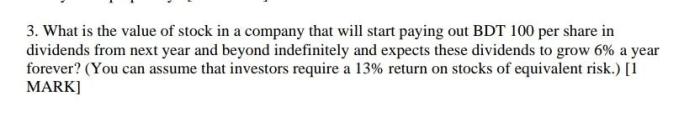

Other valuation methods include the dividend discount model (DDM), which focuses on the present value of future dividends; the book value method, which uses a company’s net asset value; and comparable company analysis, which compares valuation multiples (such as P/E ratios) to similar companies.

Comparative Analysis of Valuation Methods

| Valuation Method | Strengths | Weaknesses |

|---|---|---|

| Discounted Cash Flow (DCF) | Theoretically sound, considers future cash flows | Relies on future projections, sensitive to discount rate assumptions |

| Price-to-Earnings (P/E) Ratio | Easy to calculate and understand, widely used | Can be misleading without considering industry context and growth prospects |

| Comparable Company Analysis | Provides relative valuation benchmark | Finding truly comparable companies can be challenging |

External Factors Affecting Stock Prices

Beyond company-specific fundamentals, macroeconomic conditions, geopolitical events, and unforeseen circumstances can significantly influence stock prices.

Impact of Macroeconomic Factors

Source: cheggcdn.com

Interest rates, inflation, and economic growth rates are key macroeconomic factors affecting stock prices. Higher interest rates can increase borrowing costs for companies and reduce investor appetite for stocks, leading to price declines. Inflation erodes purchasing power and can negatively impact corporate profits. Strong economic growth typically boosts corporate earnings and investor confidence, driving stock prices higher.

Geopolitical Events and Stock Market Volatility

Geopolitical events, such as wars, political instability, and international trade disputes, can create uncertainty and volatility in the stock market. These events can negatively impact investor confidence, leading to stock price declines. For example, the outbreak of a major international conflict can cause significant market disruptions and stock price fluctuations.

Regulatory Changes and Stock Prices

Regulatory changes, such as new environmental regulations or changes in tax laws, can impact stock prices. Positive regulatory changes that benefit specific industries can lead to stock price increases, while negative changes can cause declines. For example, stricter environmental regulations might negatively impact companies in polluting industries.

Understanding stock price fundamentally involves grasping the market’s valuation of a company’s shares. This valuation fluctuates constantly, reflecting investor sentiment and various market factors. To illustrate, consider the current market dynamics influencing the cgon stock price , a prime example of how external pressures and internal performance impact share value. Ultimately, defining stock price requires analyzing a complex interplay of factors that influence investor perception and trading activity.

Unexpected Events and Stock Prices

Unexpected events, such as natural disasters, pandemics, or major technological disruptions, can have a significant and unpredictable impact on stock prices. These events can create widespread uncertainty and volatility, leading to both sharp increases and decreases in stock prices depending on the nature of the event and its impact on various sectors. The COVID-19 pandemic, for instance, initially caused a sharp market downturn followed by a period of volatility.

Stock Price Volatility and Risk

Understanding stock price volatility and associated risks is crucial for informed investment decisions.

Beta and Stock Price Volatility

Beta measures a stock’s volatility relative to the overall market. A beta greater than 1 indicates higher volatility than the market, while a beta less than 1 suggests lower volatility. Investors should consider a stock’s beta when assessing its risk profile.

Interpreting Stock Price Charts

Stock price charts display historical price data, allowing investors to identify trends and patterns. Analyzing price movements, volume, and other indicators can help predict future price directions, although this is not an exact science. Understanding chart patterns like support and resistance levels, trendlines, and moving averages can provide valuable insights.

Types of Risk in Stock Investments, Define stock price

Several types of risks are associated with stock investments, including market risk (overall market fluctuations), company-specific risk (risks related to a particular company’s performance), interest rate risk, inflation risk, and geopolitical risk. Diversification is a key strategy to mitigate these risks.

Impact of High and Low Volatility on Investment Returns

Imagine two hypothetical scenarios. In a high-volatility scenario, a stock’s price might fluctuate dramatically, potentially leading to substantial gains or losses in a short period. In a low-volatility scenario, the price changes are more gradual, resulting in smaller, but potentially more consistent, returns. The appropriate level of volatility depends on an investor’s risk tolerance and investment timeframe.

Commonly Asked Questions

What is a stock split?

A stock split increases the number of shares outstanding while proportionally decreasing the price per share. It doesn’t change the overall value of the company.

How do dividends affect stock price?

Dividends, when paid, typically cause a slight decrease in the stock price on the ex-dividend date, as the company’s cash reserves are reduced.

What is short selling?

Short selling involves borrowing shares, selling them, and hoping to buy them back later at a lower price to profit from the price difference. It’s a high-risk strategy.

What are penny stocks?

Penny stocks are shares of small companies that trade at very low prices. They are often considered highly speculative and risky investments.