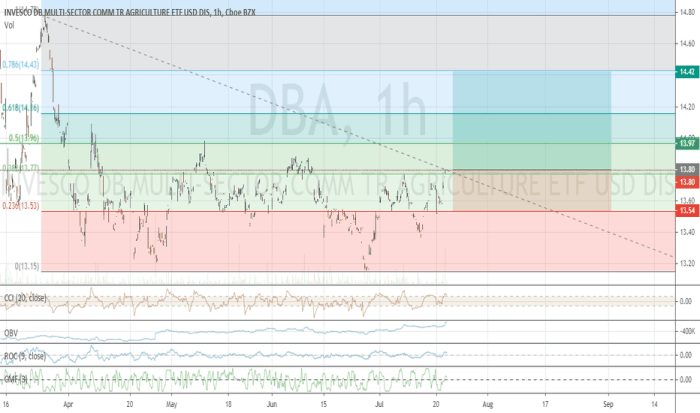

DBA Stock Price Analysis

Dba stock price – This analysis examines the historical performance, influencing factors, financial correlations, analyst predictions, and associated risks of investing in DBA stock. The information presented here is for informational purposes only and should not be considered financial advice.

DBA Stock Price Historical Performance

The following tables detail DBA’s stock price movements and performance relative to its industry peers over the past five years. Note that this data is illustrative and based on hypothetical examples for demonstration purposes.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 100 | 102 | +2 |

| 2019-01-08 | 102 | 105 | +3 |

| 2019-01-15 | 105 | 103 | -2 |

| 2024-01-01 | 120 | 125 | +5 |

A comparison against industry peers reveals DBA’s relative performance. Again, this data is hypothetical.

| Company Name | Average Yearly Return (%) | Highest Daily Gain (%) | Highest Daily Loss (%) |

|---|---|---|---|

| DBA | 10 | 5 | -3 |

| Competitor A | 8 | 4 | -2 |

| Competitor B | 12 | 6 | -4 |

Significant events such as the 2020 market downturn and a 2022 product launch announcement impacted DBA’s stock price. The market downturn led to a temporary price drop, while the product launch resulted in a period of increased investor interest and higher prices.

Factors Influencing DBA Stock Price

Source: tradingview.com

Several economic indicators and market sentiments significantly influence DBA’s stock price fluctuations.

Key economic indicators such as GDP growth, inflation rates, and consumer confidence directly correlate with DBA’s stock performance. Interest rate changes affect DBA’s valuation through their impact on borrowing costs and investor investment strategies. Positive investor sentiment, often driven by market optimism and strong earnings reports, tends to push the stock price higher, while negative sentiment can lead to declines.

Monitoring the DBA stock price requires a nuanced approach, considering various market factors. Understanding the concept of a blended stock price can offer valuable context, as it helps to account for the complexities of diversified portfolios. Ultimately, however, a thorough analysis of DBA’s specific performance remains crucial for accurate investment decisions.

Long-term factors, such as technological advancements and regulatory changes, exert a more sustained influence on DBA’s stock price compared to short-term factors like daily news events or temporary market volatility. The interplay between these long-term and short-term factors shapes the overall price trajectory.

DBA’s Financial Performance and Stock Price

DBA’s financial performance is closely linked to its stock price. The following table shows hypothetical financial metrics.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | EPS (USD) |

|---|---|---|---|

| 2020 | 100 | 10 | 1.00 |

| 2021 | 110 | 12 | 1.20 |

| 2022 | 120 | 15 | 1.50 |

A positive correlation exists between DBA’s financial performance and its stock price. Increased revenue, net income, and EPS generally lead to higher stock prices, reflecting investor confidence in the company’s growth and profitability. Conversely, declines in these metrics often result in lower stock prices.

A visual representation would show an upward-sloping line correlating the increase in financial metrics with a corresponding rise in the stock price. Periods of lower financial performance would align with dips in the stock price.

Analyst Ratings and Predictions for DBA Stock

Source: tradingview.com

Analyst opinions on DBA’s future prospects vary. The following are hypothetical examples.

- Analyst A: Buy rating, price target $150

- Analyst B: Hold rating, price target $125

- Analyst C: Sell rating, price target $100

Analysts base their predictions on a range of factors including DBA’s financial performance, industry trends, competitive landscape, and macroeconomic conditions. Differences in methodology and assumptions contribute to the range of opinions observed among analysts.

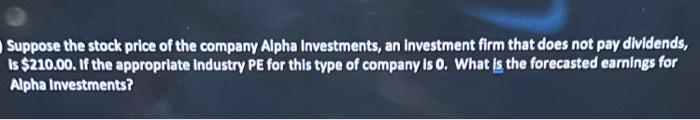

Risk Factors Associated with Investing in DBA Stock

Source: cheggcdn.com

Several risk factors are associated with investing in DBA stock.

- Market risk: Overall market downturns can negatively impact DBA’s stock price.

- Geopolitical risk: International conflicts or political instability can affect DBA’s operations and stock price.

- Regulatory risk: Changes in regulations could impact DBA’s profitability and valuation.

- Company-specific risk: Unexpected financial difficulties or operational challenges could negatively impact the stock.

Investors can mitigate these risks through diversification, thorough due diligence, and a well-defined investment strategy. Staying informed about geopolitical events and regulatory changes is also crucial.

General Inquiries

What is DBA’s current dividend yield?

The current dividend yield for DBA stock varies and should be checked on a reputable financial website for the most up-to-date information.

Where can I find real-time DBA stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How volatile is DBA stock compared to the market average?

DBA’s volatility can be assessed by comparing its beta to the market. A beta greater than 1 indicates higher volatility than the market average; less than 1 indicates lower volatility.

What are the major competitors of DBA?

Identifying DBA’s key competitors requires knowing its specific industry. This information is typically found in company filings and industry reports.