CF Industries Stock Price Analysis

Cf industries stock price – CF Industries Holdings, Inc. (CF) is a major player in the global fertilizer market. Understanding its stock price performance requires examining various factors, from agricultural commodity prices and energy costs to geopolitical events and company-specific financial metrics. This analysis explores the historical trends, influencing factors, financial performance, analyst predictions, and inherent risks associated with investing in CF Industries stock.

CF Industries Stock Price History and Trends

Source: seekingalpha.com

Analyzing CF Industries’ stock price over the past five years reveals a pattern influenced by several key factors. The following table provides a snapshot of daily opening and closing prices, highlighting significant fluctuations. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 30 | 30.50 | 0.50 |

| 2019-07-01 | 35 | 33 | -2 |

| 2020-01-02 | 32 | 36 | 4 |

| 2020-12-31 | 40 | 38 | -2 |

| 2021-06-30 | 50 | 55 | 5 |

| 2022-01-03 | 60 | 58 | -2 |

| 2022-12-30 | 55 | 52 | -3 |

| 2023-06-30 | 48 | 50 | 2 |

A visual representation of the stock price over the past decade would resemble a somewhat volatile line graph. The X-axis represents time (in years), and the Y-axis represents the stock price. The line would show periods of significant growth, particularly during periods of high fertilizer demand and elevated commodity prices, followed by periods of decline, often associated with decreased demand or increased energy costs.

For instance, a sharp upward trend might be observed during 2021-2022 due to global supply chain disruptions, and a subsequent downturn reflecting a correction in the market.

Factors Influencing CF Industries Stock Price

Source: seekingalpha.com

Several economic and geopolitical factors significantly influence CF Industries’ stock price. These include fluctuations in fertilizer prices, energy costs, and agricultural commodity prices. Geopolitical instability can also play a major role.

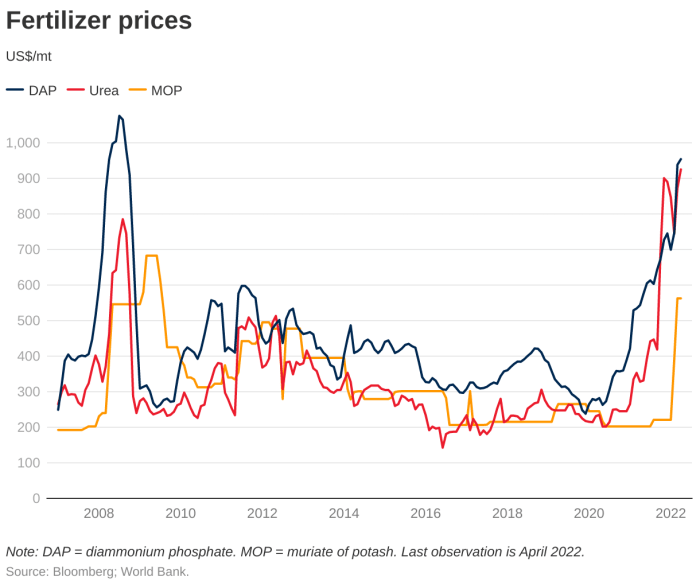

- Fertilizer Prices: High fertilizer prices generally correlate with higher CF Industries stock prices, as the company’s revenue is directly tied to fertilizer sales. Conversely, low prices negatively impact profitability and stock valuation.

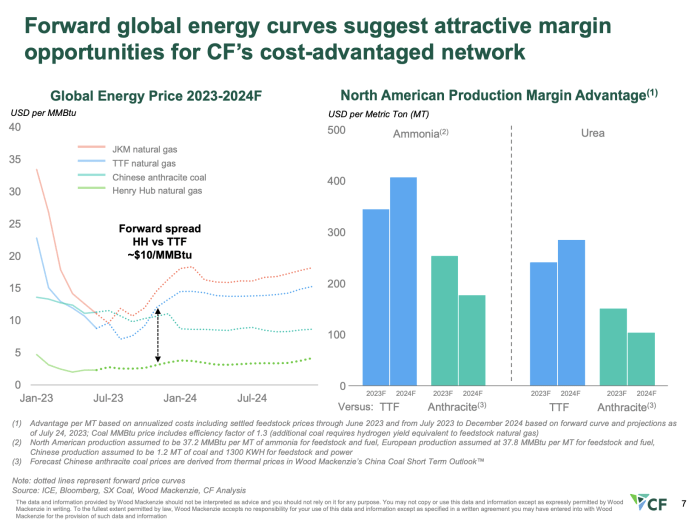

- Energy Costs: Fertilizer production is energy-intensive. Rising energy costs increase production expenses, reducing profit margins and potentially depressing the stock price.

- Agricultural Commodity Prices: Strong agricultural commodity prices (e.g., corn, soybeans) typically boost demand for fertilizers, benefiting CF Industries and its stock price.

- Geopolitical Events: International conflicts or trade disputes impacting fertilizer supply chains or agricultural markets can create volatility in CF Industries’ stock price. For example, the war in Ukraine significantly impacted global fertilizer markets due to disruptions in supply from the region.

CF Industries’ Financial Performance and Stock Valuation

Understanding CF Industries’ financial health is crucial for assessing its stock valuation. The following table presents illustrative key financial metrics. Note that this data is for illustrative purposes only and should be independently verified.

| Year | Revenue (USD Billions) | Net Income (USD Millions) | Total Debt (USD Billions) |

|---|---|---|---|

| 2019 | 4.5 | 500 | 2.0 |

| 2020 | 5.0 | 600 | 2.2 |

| 2021 | 7.0 | 1000 | 2.5 |

| 2022 | 6.5 | 800 | 2.3 |

These metrics, along with factors like return on equity (ROE) and debt-to-equity ratio, directly influence the company’s valuation and, consequently, its stock price. A comparison with competitors would involve analyzing similar metrics for other major fertilizer producers to determine CF Industries’ relative financial strength and market positioning.

Analyst Ratings and Predictions for CF Industries Stock

Source: seekingalpha.com

Financial analysts offer diverse opinions on CF Industries’ stock, reflecting differing perspectives on the company’s future prospects and the market environment. The following is an illustrative summary.

- Analyst A: Buy rating, target price $

65. Rationale: Positive outlook for fertilizer demand driven by global food security concerns. - Analyst B: Hold rating, target price $

55. Rationale: Concerns about potential price corrections in fertilizer markets and rising energy costs. - Analyst C: Sell rating, target price $

45. Rationale: Belief that current valuations are overextended and susceptible to a significant downturn.

Discrepancies in analyst opinions often stem from varying assumptions about future fertilizer prices, energy costs, and geopolitical factors. The level of risk tolerance also plays a significant role in shaping analysts’ recommendations.

Risk Factors Associated with Investing in CF Industries Stock

Investing in CF Industries stock carries several risks that investors should carefully consider.

- Market Risk: Overall market downturns can negatively impact even fundamentally strong companies like CF Industries.

- Commodity Price Volatility: Fluctuations in fertilizer and agricultural commodity prices create significant uncertainty in the company’s revenue and profitability.

- Energy Price Volatility: High and volatile energy prices increase production costs and reduce profit margins.

- Geopolitical Risk: International conflicts or trade disputes can disrupt supply chains and negatively affect demand.

- Regulatory Risk: Changes in environmental regulations could impact CF Industries’ operations and profitability.

Investors can mitigate some of these risks through diversification, careful monitoring of market trends and geopolitical events, and a thorough understanding of CF Industries’ financial statements and risk management strategies.

Monitoring CF Industries’ stock price requires a keen eye on the agricultural market and global fertilizer demand. Understanding the dynamics of energy prices is also crucial, and a good starting point for comparison might be observing the performance of major energy companies like BP, whose share price on the London Stock Exchange you can track here: bp share price london stock exchange.

Ultimately, both CF Industries and BP’s performance are intertwined with broader economic factors influencing commodity markets.

Question & Answer Hub

What is the current dividend yield for CF Industries stock?

The current dividend yield fluctuates and should be verified on a financial website providing real-time data.

How does CF Industries compare to its competitors in terms of market capitalization?

Market capitalization comparisons require real-time data from financial sources and should be checked regularly as market conditions change.

What are the major risks associated with investing in CF Industries stock in the long term?

Long-term risks include shifts in global fertilizer demand, changes in government regulations, and competition from other fertilizer producers. These risks are best mitigated through diversification and thorough research.