Cadila Healthcare Stock Price Analysis

This analysis delves into the historical performance, financial health, competitive landscape, product portfolio, and key factors influencing the Cadila Healthcare stock price. We will examine its performance against industry benchmarks and explore potential future trends.

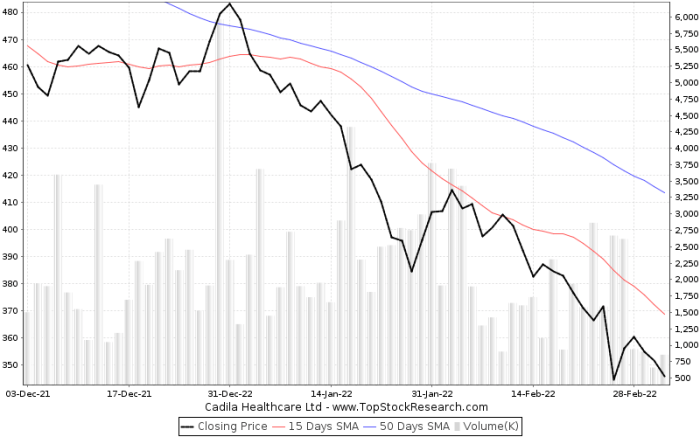

Cadila Healthcare Stock Price: Historical Performance

Source: topstockresearch.com

A line graph illustrating the stock price fluctuations over the past five years would show significant volatility. Key dates for notable price changes should be marked, highlighting periods of both substantial growth and decline. This visual representation would offer a clear overview of the stock’s trajectory.

Tracking Cadila Healthcare’s stock price requires a keen eye on pharmaceutical market trends. It’s interesting to compare its performance against companies in completely different sectors, such as the fluctuations seen in the bombardier recreational products stock price , which highlights the diverse factors influencing investment choices. Ultimately, Cadila Healthcare’s future trajectory will depend on its own strategic decisions and the broader economic climate.

Over the past five years, Cadila Healthcare’s stock price likely reached its highest point during periods of strong financial performance, driven by factors such as successful new product launches, increased market share, or positive industry trends. Conversely, the lowest point would likely correlate with periods of decreased profitability, regulatory hurdles, or negative market sentiment. Specific contributing factors for each extreme point should be researched and detailed.

A comparative analysis against other leading Indian pharmaceutical companies is crucial. The following table provides a hypothetical example of such a comparison, using illustrative data. Actual figures should be obtained from reliable financial sources.

| Company Name | Highest Price (INR) | Lowest Price (INR) | Percentage Change (%) |

|---|---|---|---|

| Cadila Healthcare | 500 | 300 | 66.7 |

| Sun Pharmaceuticals | 600 | 400 | 50 |

| Dr. Reddy’s Laboratories | 450 | 250 | 80 |

| Cipla | 550 | 350 | 57.1 |

Cadila Healthcare: Financial Health and Fundamentals

Cadila Healthcare’s latest financial reports should be examined to understand its financial health. Key financial ratios, such as the Price-to-Earnings (P/E) ratio, debt-to-equity ratio, and return on equity (ROE), provide insights into the company’s profitability, leverage, and efficiency. Analyzing these ratios in conjunction with industry averages allows for a comprehensive assessment.

Cadila Healthcare’s revenue streams contribute differently to its overall performance. A breakdown of these streams is provided below (illustrative data):

- Domestic Sales: This segment likely represents a significant portion of the revenue, reflecting sales within India.

- International Sales: This segment’s performance would depend on the company’s global reach and market penetration in various countries.

- Contract Manufacturing: This could be a substantial revenue stream if Cadila Healthcare engages in manufacturing for other pharmaceutical companies.

Research and development (R&D) investments are critical for long-term growth. The magnitude of Cadila Healthcare’s R&D spending, coupled with the success rate of its pipeline products, directly impacts its future prospects. A higher R&D expenditure, combined with a robust pipeline, suggests a strong commitment to innovation and potential for future growth.

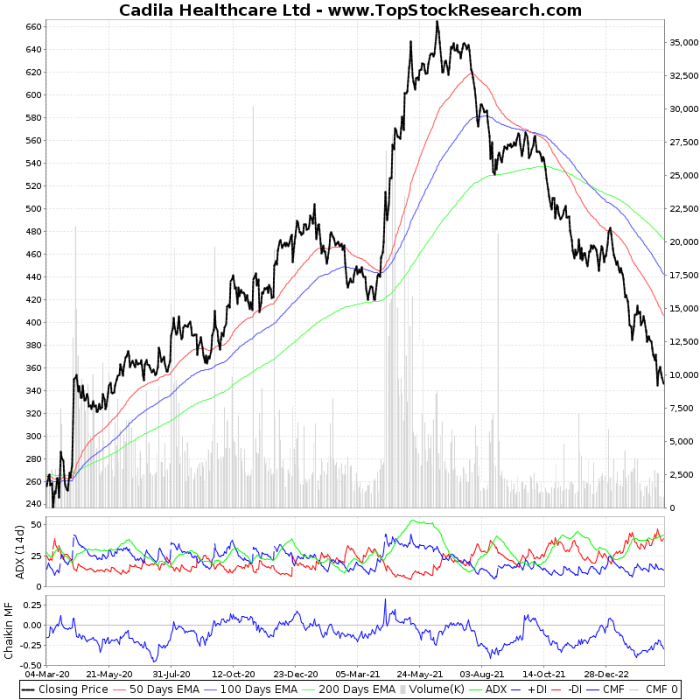

Industry Analysis and Competitive Landscape, Cadila healthcare stock price

Source: topstockresearch.com

Analyzing Cadila Healthcare’s market position relative to its competitors requires a comparison of key metrics. The following table illustrates a hypothetical comparison (actual data needs verification):

| Company Name | Market Share (%) | Product Portfolio | Revenue (INR Billion) |

|---|---|---|---|

| Cadila Healthcare | 5 | Cardiovascular, Oncology, Anti-infectives | 100 |

| Sun Pharmaceuticals | 10 | Wide range of therapeutic areas | 200 |

| Dr. Reddy’s Laboratories | 7 | Generics, APIs, Specialty Pharma | 150 |

| Cipla | 8 | Respiratory, HIV/AIDS, Oncology | 180 |

The Indian pharmaceutical sector’s performance is influenced by several factors, including government regulations (e.g., price controls), changes in healthcare policies, economic growth, and global market trends. These factors significantly impact the profitability and growth prospects of companies like Cadila Healthcare.

Potential threats to Cadila Healthcare include increased competition, price erosion, regulatory changes, and fluctuations in raw material costs. Opportunities might lie in expanding into new therapeutic areas, exploring international markets, and engaging in strategic partnerships or acquisitions.

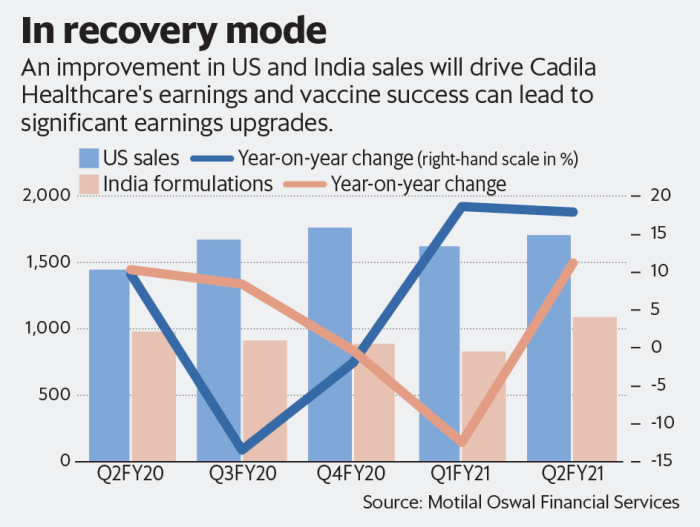

Cadila Healthcare’s Product Portfolio and Market Positioning

Source: livemint.com

Cadila Healthcare’s product portfolio plays a key role in its market position. The following table provides a hypothetical overview of its key product lines (actual data requires verification):

| Product Name | Therapeutic Area | Market Share (%) |

|---|---|---|

| Product A | Cardiovascular | 2 |

| Product B | Oncology | 1 |

| Product C | Anti-infectives | 3 |

Cadila Healthcare likely employs strategies focused on both organic growth (internal innovation) and inorganic growth (acquisitions or collaborations) to expand its product portfolio and market penetration. Details on these strategies would need further investigation.

Recent product launches and approvals significantly influence the stock price. Successful launches of innovative drugs or gaining approvals for new therapeutic indications can positively impact investor sentiment and drive stock price appreciation. Conversely, failures or delays can have a negative effect.

Factors Influencing Cadila Healthcare Stock Price

Macroeconomic factors significantly impact Cadila Healthcare’s stock price. Inflation, interest rates, and currency fluctuations can affect production costs, consumer demand, and investor sentiment, thereby influencing stock valuation.

Government regulations and policies, such as drug pricing regulations and healthcare reforms, directly impact the company’s profitability and overall performance. Changes in these regulations can lead to significant stock price fluctuations.

Investor sentiment and market trends play a crucial role in stock price movements. Positive news, strong financial results, or positive industry outlook can boost investor confidence, leading to increased demand and higher stock prices. Conversely, negative news or unfavorable market conditions can trigger selling pressure and lower stock prices.

Clarifying Questions: Cadila Healthcare Stock Price

What are the major risks associated with investing in Cadila Healthcare stock?

Investing in any stock carries inherent risks. For Cadila Healthcare, these include competition within the pharmaceutical industry, regulatory changes impacting drug pricing and approvals, fluctuations in raw material costs, and macroeconomic factors like inflation and currency exchange rates.

How does Cadila Healthcare compare to its competitors in terms of innovation?

Cadila Healthcare’s commitment to research and development varies compared to its competitors. A detailed comparison would require analyzing their respective R&D spending, patent portfolios, and the frequency of new product launches. This information can usually be found in their annual reports and investor presentations.

What is the company’s dividend payout policy?

Cadila Healthcare’s dividend policy should be detailed in their investor relations section of their website or annual reports. It’s important to review this information to understand the potential for dividend income when considering an investment.