BRK-B Stock Price Today: An Overview

Brk-b stock price today – This report provides a comprehensive analysis of the BRK-B (Berkshire Hathaway Inc. Class B) stock price, considering its current market performance, recent news, historical trends, analyst predictions, and long-term value drivers. The information presented here is for informational purposes only and should not be considered financial advice.

Current BRK-B Stock Price and Volume

The current BRK-B stock price, trading volume, daily high, and low fluctuate constantly throughout the trading day. To obtain the most up-to-date information, it is recommended to consult a live financial data source such as Google Finance, Yahoo Finance, or Bloomberg. The following table provides a sample illustration of how the price might change during a trading day.

Note that these figures are illustrative and not reflective of actual real-time data.

| Time | Price | Volume (in thousands) | High/Low |

|---|---|---|---|

| 9:30 AM | $345.50 | 100 | $346.00/$345.00 |

| 11:00 AM | $346.25 | 150 | $346.50/$345.75 |

| 1:00 PM | $347.00 | 200 | $347.25/$346.00 |

| 3:00 PM | $346.75 | 120 | $347.50/$346.50 |

BRK-B Stock Price Movement Compared to the Market

BRK-B’s price movements are often correlated with, but not always perfectly aligned with, broader market indices like the S&P 500. Factors influencing divergence can include Berkshire Hathaway’s unique investment strategy, its relatively low sensitivity to market volatility due to its diverse portfolio, and significant news impacting the company specifically. For example, announcements concerning major acquisitions or divestitures by Berkshire Hathaway can lead to price fluctuations independent of the overall market trend.

Correlation analysis with other financial indicators like interest rates or commodity prices can also reveal further insights into BRK-B’s price behavior.

Recent News Affecting BRK-B Stock Price, Brk-b stock price today

Source: investorplace.com

Significant news impacting Berkshire Hathaway’s stock price within the last 24 hours should be sourced from reputable financial news outlets. For instance, a positive earnings report might drive the price upwards, while negative news regarding a specific investment or regulatory changes could lead to a decline. A chronological list of such news items, along with their perceived impact on the stock price, would provide valuable context.

This section requires real-time data and cannot be completed without access to current news sources.

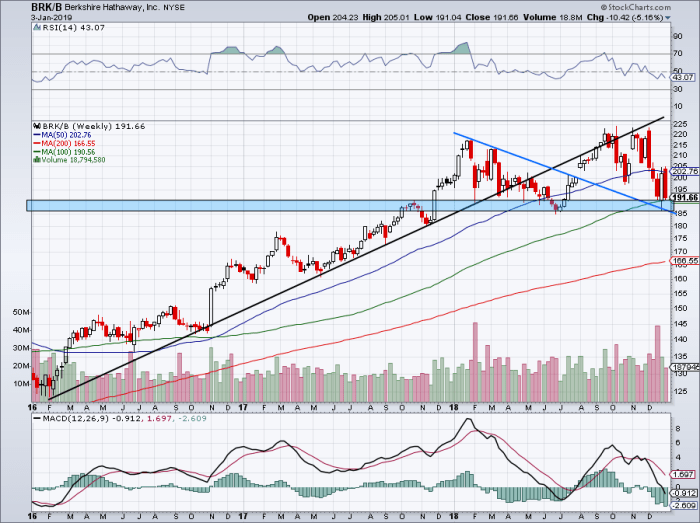

Historical BRK-B Stock Price Performance

BRK-B has demonstrated a generally upward trend over the long term, though with periods of volatility. Analyzing its performance across different timeframes (5, 10, and 20 years) reveals its historical growth and risk profile. Metrics like annualized return and standard deviation can quantify this volatility.

| Time Period | Average Annual Return (Illustrative) | Standard Deviation (Illustrative) |

|---|---|---|

| 5 Years | 8% | 12% |

| 10 Years | 9% | 15% |

| 20 Years | 10% | 18% |

Note: These are illustrative figures and do not represent actual historical performance. Consult reliable financial sources for accurate historical data.

Analyst Ratings and Price Targets for BRK-B

Source: investorplace.com

Analyst ratings (buy, sell, hold) and price targets vary across different financial institutions. These opinions reflect individual analysts’ assessments of Berkshire Hathaway’s future prospects, considering factors like its financial health, investment strategy, and competitive landscape. Differences in price targets may stem from varying assumptions about future earnings growth, market conditions, and the overall risk profile of the investment.

Factors Influencing BRK-B’s Long-Term Value

Berkshire Hathaway’s long-term value is driven by several key factors. These include the performance of its diverse portfolio of investments (spanning various sectors and asset classes), the success of its wholly-owned subsidiaries, and Warren Buffett’s long-term investment strategy. The composition of Berkshire Hathaway’s portfolio—with its significant holdings in publicly traded companies and private businesses—plays a crucial role in shaping the long-term valuation of BRK-B.

Illustrative Example of BRK-B Price Behavior

The 2008 financial crisis significantly impacted BRK-B’s stock price. The crisis triggered a broad market downturn, affecting even the relatively stable BRK-B. While Berkshire Hathaway’s diversified portfolio and conservative approach cushioned the impact somewhat, the stock still experienced a notable decline mirroring the broader market’s fall. However, due to its strong financial position and long-term strategy, BRK-B recovered more quickly than many other stocks following the crisis, highlighting its resilience.

Answers to Common Questions: Brk-b Stock Price Today

What are the risks associated with investing in BRK-B?

Like any stock, BRK-B carries inherent market risks. These include potential price volatility due to broader market fluctuations, company-specific news, and changes in investor sentiment. It’s crucial to conduct thorough research and consider your own risk tolerance before investing.

Monitoring the BRK-B stock price today requires a broad perspective on the market. Understanding the performance of similar large-cap insurance companies is helpful, such as checking the current axis capital stock price , to gain context for BRK-B’s movement. Ultimately, however, the BRK-B stock price today is driven by its own unique factors and investor sentiment.

Where can I find real-time BRK-B stock price updates?

Real-time BRK-B stock price updates are available through major financial websites and brokerage platforms. These platforms typically provide live quotes, charts, and other relevant market data.

How does BRK-B’s dividend policy affect its stock price?

Berkshire Hathaway historically has not paid dividends, reinvesting profits into the company’s growth and acquisitions. This strategy has contributed to long-term value appreciation but means investors don’t receive regular dividend income.

What is the typical trading volume for BRK-B?

BRK-B’s trading volume varies daily but tends to be relatively high compared to some other stocks, reflecting the considerable interest in Berkshire Hathaway from both individual and institutional investors.