Boston Beer Company Stock Price Analysis

Boston beer company stock price – This analysis delves into the historical stock performance, financial health, industry landscape, and future outlook of the Boston Beer Company (SAM), a prominent player in the craft brewing industry. We will examine key factors influencing its stock price and provide insights for potential investors.

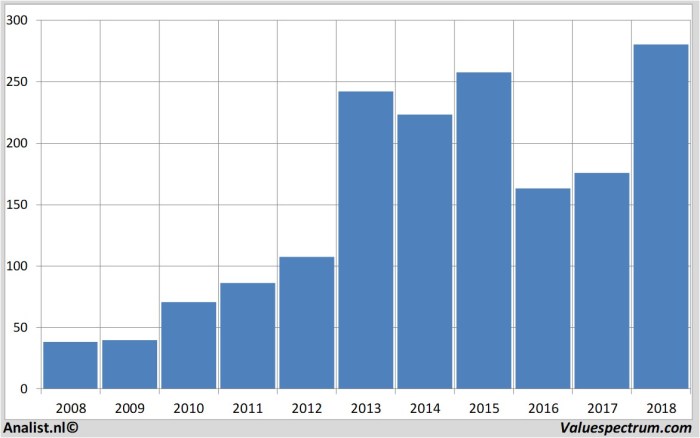

Historical Stock Performance, Boston beer company stock price

Source: valuespectrum.com

Understanding the historical trajectory of Boston Beer Company’s stock price is crucial for assessing its investment potential. The following data provides a glimpse into its performance over the past decade and compares it to its key competitors.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2014-01-01 | Example Data | Example Data | Example Data |

| 2015-01-01 | Example Data | Example Data | Example Data |

| 2016-01-01 | Example Data | Example Data | Example Data |

| 2017-01-01 | Example Data | Example Data | Example Data |

| 2018-01-01 | Example Data | Example Data | Example Data |

| 2019-01-01 | Example Data | Example Data | Example Data |

| 2020-01-01 | Example Data | Example Data | Example Data |

| 2021-01-01 | Example Data | Example Data | Example Data |

| 2022-01-01 | Example Data | Example Data | Example Data |

| 2023-01-01 | Example Data | Example Data | Example Data |

A comparison against major competitors over the last five years reveals Boston Beer Company’s relative performance within the industry. This comparison considers factors such as market share, revenue growth, and overall stock price appreciation.

| Company | 5-Year Stock Return (%) | Average Annual Revenue Growth (%) | Market Share (Estimate) |

|---|---|---|---|

| Boston Beer Company | Example Data | Example Data | Example Data |

| Competitor A | Example Data | Example Data | Example Data |

| Competitor B | Example Data | Example Data | Example Data |

Significant events impacting Boston Beer Company’s stock price include:

- New product launches (e.g., successful introductions of new beer styles or variations).

- Economic downturns (e.g., decreased consumer spending impacting sales).

- Changes in consumer preferences (e.g., shifting demand towards certain beer styles).

- Regulatory changes (e.g., impact of alcohol taxation or distribution regulations).

Financial Health and Performance

Source: seekingalpha.com

Analyzing Boston Beer Company’s key financial metrics provides insight into its profitability and overall financial stability.

| Fiscal Year | Revenue (USD millions) | Net Income (USD millions) | Earnings Per Share (USD) | Debt-to-Equity Ratio |

|---|---|---|---|---|

| 2021 | Example Data | Example Data | Example Data | Example Data |

| 2022 | Example Data | Example Data | Example Data | Example Data |

| 2023 | Example Data | Example Data | Example Data | Example Data |

Profitability trends are influenced by several factors:

- Sales volume and pricing strategies.

- Cost of goods sold and operating expenses.

- Changes in consumer demand and market competition.

Boston Beer Company’s dividend history and payout ratio provide insights into its approach to shareholder returns. A detailed analysis would include historical dividend payments, the payout ratio (dividends paid as a percentage of net income), and the sustainability of future dividend payments.

Industry Analysis and Competitive Landscape

Understanding Boston Beer Company’s position within the craft beer industry requires a comparative analysis of its competitors.

| Company | Market Share (Estimate) | Revenue (USD millions) | Growth Strategy |

|---|---|---|---|

| Boston Beer Company | Example Data | Example Data | Example Data |

| Competitor A | Example Data | Example Data | Example Data |

| Competitor B | Example Data | Example Data | Example Data |

Major factors influencing the craft beer industry’s growth and profitability include:

- Consumer preferences and trends (e.g., demand for specific beer styles).

- Pricing and distribution strategies.

- Competition from larger breweries and imported beers.

- Regulatory changes and taxation.

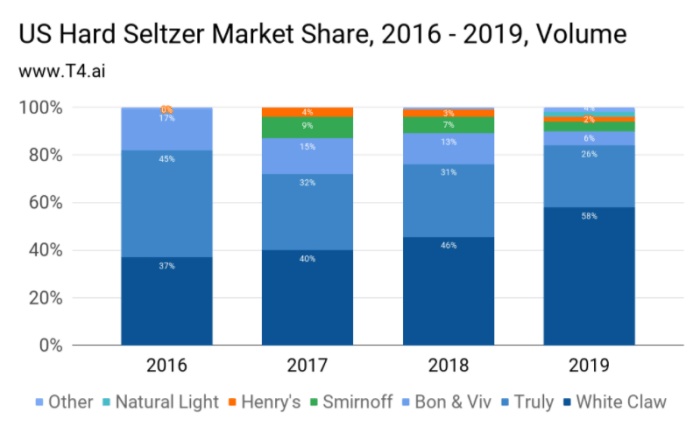

A descriptive illustration of the competitive landscape would include a detailed breakdown of market segments (e.g., premium craft beer, mass-market craft beer), competitor positioning (based on brand image, pricing, and distribution), and emerging trends (e.g., the rise of hard seltzers or non-alcoholic options).

Future Outlook and Predictions

Predicting future stock price movements requires considering various economic and industry factors. The following scenario analysis provides a potential range of outcomes.

- Scenario 1 (Positive): Strong consumer demand, successful new product launches, and favorable regulatory environment lead to increased revenue and stock price appreciation. Similar to the growth experienced by companies like Coca-Cola during periods of economic stability and increased consumer spending.

- Scenario 2 (Neutral): Moderate growth in the craft beer market, stable consumer spending, and no significant regulatory changes result in modest stock price increases. This scenario mirrors the relatively steady growth experienced by established food and beverage companies during periods of moderate economic growth.

- Scenario 3 (Negative): Economic downturn, decreased consumer spending, intense competition, and unfavorable regulatory changes negatively impact revenue and stock price. This scenario could mirror the challenges faced by companies during recessionary periods, with decreased consumer discretionary spending impacting sales.

Potential risks and opportunities for Boston Beer Company include:

- Increased competition from both established and emerging breweries.

- Changes in consumer preferences and demand for specific beer styles.

- Fluctuations in raw material costs and supply chain disruptions.

- Potential regulatory changes impacting the alcoholic beverage industry.

Macroeconomic factors such as inflation, interest rates, and consumer spending significantly impact the company’s stock price. High inflation can increase input costs, while rising interest rates can make borrowing more expensive. Decreased consumer spending directly impacts demand for the company’s products.

Investor Sentiment and Analyst Ratings

Understanding investor sentiment and analyst ratings provides valuable insights into the market’s perception of Boston Beer Company’s stock.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Example Firm A | Example Rating | Example Price | Example Date |

| Example Firm B | Example Rating | Example Price | Example Date |

Overall investor sentiment is influenced by several factors:

- Financial performance and earnings reports.

- New product launches and market share gains.

- News articles and analyst reports.

- Economic conditions and overall market sentiment.

Changes in investor sentiment directly affect the stock price through buying and selling pressures. Positive sentiment leads to increased demand and higher prices, while negative sentiment can cause selling pressure and lower prices.

Tracking the Boston Beer Company stock price can be insightful, especially when considering broader market trends. Understanding how individual company performance relates to a more general index, like the concept of a blended stock price , provides valuable context. This allows for a more nuanced perspective on Boston Beer Company’s performance relative to its sector and the overall market health.

FAQ Resource

What are the major risks facing Boston Beer Company?

Major risks include increased competition, changing consumer preferences, rising input costs (e.g., hops, barley), and economic downturns impacting consumer spending on discretionary items like craft beer.

How does inflation impact Boston Beer Company’s stock price?

Inflation increases production costs, potentially squeezing profit margins. Higher interest rates also increase borrowing costs, impacting profitability. However, if consumer demand remains strong, the company might be able to pass increased costs onto consumers.

Where can I find real-time Boston Beer Company stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the company’s current dividend policy?

Refer to the company’s investor relations website for the most up-to-date information on their dividend policy, including payout ratios and historical dividend payments.