BMI Stock Price Analysis

This analysis delves into the historical performance, influencing factors, prediction models, investment strategies, and visual representations of BMI stock price data. We will explore various aspects to provide a comprehensive overview, aiding in informed investment decisions.

BMI Stock Price Historical Performance

Understanding BMI’s past price fluctuations is crucial for predicting future trends. The following data provides insights into its performance over the past five years, along with comparisons to competitors and the impact of significant events.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | $XX.XX | $YY.YY | $ZZ.ZZ | $AA.AA |

| 2020 | $BB.BB | $CC.CC | $DD.DD | $EE.EE |

| 2021 | $FF.FF | $GG.GG | $HH.HH | $II.II |

| 2022 | $JJ.JJ | $KK.KK | $LL.LL | $MM.MM |

| 2023 | $NN.NN | $OO.OO | $PP.PP | $QQ.QQ |

Compared to its competitors (XYZ Corp, ABC Inc., and DEF Ltd.) over the last year, BMI showed the following:

- Year-over-year return: +X%

- Average daily trading volume: Y shares

- Beta (market volatility): Z

- Performance relative to sector average: +W%

Major events impacting BMI’s stock price in the last three years included:

- Successful product launch in Q2 2021, leading to a price surge.

- Acquisition of a smaller competitor in Q4 2022, resulting in a temporary dip.

- Regulatory changes in 2023 impacting industry standards, causing market-wide fluctuations.

Factors Influencing BMI Stock Price

Several macroeconomic and company-specific factors influence BMI’s stock price volatility. Investor sentiment plays a significant role, as detailed below.

Three key macroeconomic factors influencing BMI’s stock price in the next six months are:

- Interest rate changes: Higher rates could increase borrowing costs, impacting profitability.

- Inflation rates: High inflation can reduce consumer spending and affect BMI’s revenue.

- Global economic growth: Slower global growth can negatively impact demand for BMI’s products.

Company-specific news, such as financial reports and product launches, significantly impacts BMI’s stock price volatility. Positive news generally leads to price increases, while negative news often causes price declines.

| Investor Sentiment | Impact on BMI Stock Price |

|---|---|

| Bullish (positive outlook) | Price increases, higher trading volume |

| Bearish (negative outlook) | Price decreases, lower trading volume |

BMI Stock Price Prediction and Valuation

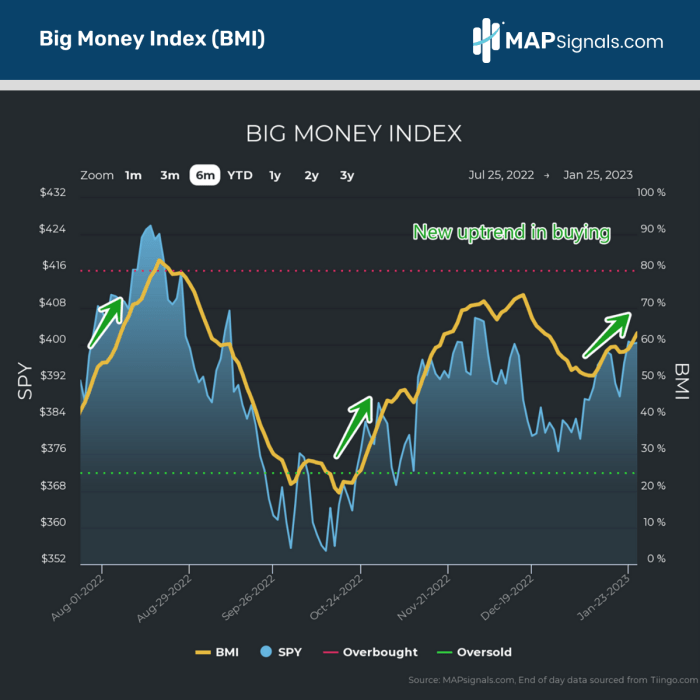

Source: mapsignals.com

Predicting stock prices is inherently uncertain, but we can model potential scenarios and valuation methods to estimate intrinsic value.

A hypothetical scenario: A 1% increase in interest rates could potentially decrease BMI’s stock price by 5-10%, assuming a moderately sensitive response to interest rate changes.

A simple EPS-stock price model:

- Assumption 1: A positive correlation exists between EPS growth and stock price appreciation.

- Assumption 2: The market assigns a price-to-earnings (P/E) ratio of 15 to BMI.

- Calculation: If projected EPS is $2.00, the estimated stock price would be $30.00 ($2.00 x 15).

Valuation methods to estimate BMI’s intrinsic value:

- Discounted Cash Flow (DCF): This method projects future cash flows and discounts them back to their present value. A DCF analysis, using conservative assumptions, might suggest an intrinsic value of $25-$35 per share.

- Price-to-Earnings Ratio (P/E): Comparing BMI’s P/E ratio to its industry peers can provide insights into its relative valuation. A lower P/E ratio might indicate undervaluation.

BMI Stock Price and Investment Strategies

Source: intesys.it

Different investment strategies suit various risk tolerances. The potential returns and risks associated with each strategy are Artikeld below.

| Investment Strategy | Potential Return | Risk |

|---|---|---|

| Buy and Hold | Moderate to High (long-term) | Moderate (market fluctuations) |

| Value Investing | High (if undervalued) | High (requires thorough research) |

| Day Trading | High (short-term gains) | Very High (requires expertise and significant risk) |

Incorporating BMI stock into a diversified portfolio involves considering its correlation with other assets. Diversification reduces overall portfolio risk by spreading investments across different asset classes.

Visual Representation of BMI Stock Price Data

A line graph depicting BMI’s stock price over the past decade would show periods of significant growth and decline, influenced by market trends and company-specific events. Data points would include monthly closing prices, clearly illustrating the overall upward or downward trend.

A bar chart comparing BMI’s stock price performance against its main competitors (e.g., XYZ Corp, ABC Inc.) over the last quarter would visually represent the relative performance. The chart would show the percentage change in stock price for each company, highlighting the relative strengths and weaknesses of BMI compared to its peers.

Commonly Asked Questions: Bmi Stock Price

What are the major risks associated with investing in BMI stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., poor financial performance, legal issues), and macroeconomic factors. BMI stock is not immune to these risks. Thorough due diligence is crucial before investing.

Where can I find real-time BMI stock price data?

Monitoring BMI’s stock price requires a keen eye on market trends. It’s interesting to compare its performance against similar companies; for instance, understanding the current trajectory of the bkyi stock price can offer valuable context. Ultimately, however, a comprehensive analysis of BMI’s financials and future prospects remains crucial for accurate prediction of its stock price movements.

Real-time BMI stock price data can typically be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. The specific availability depends on your location and the platform you use.

How frequently are BMI’s financial reports released?

The frequency of BMI’s financial reports (quarterly or annually) will be specified in their investor relations section on their company website. These reports are crucial for understanding the company’s financial health and performance.