Berkshire Hathaway Stock Price: A Comprehensive Analysis

Berkshire hathaway stock price a – Berkshire Hathaway, the conglomerate chaired by Warren Buffett, has a long and storied history, reflected in the fluctuating yet generally upward trajectory of its stock price. Understanding the factors driving this price movement is crucial for investors considering adding BRK.A or BRK.B to their portfolios. This analysis delves into the historical trends, influencing factors, financial performance, investor sentiment, and potential future price movements of Berkshire Hathaway stock.

Berkshire Hathaway Stock Price Historical Trends, Berkshire hathaway stock price a

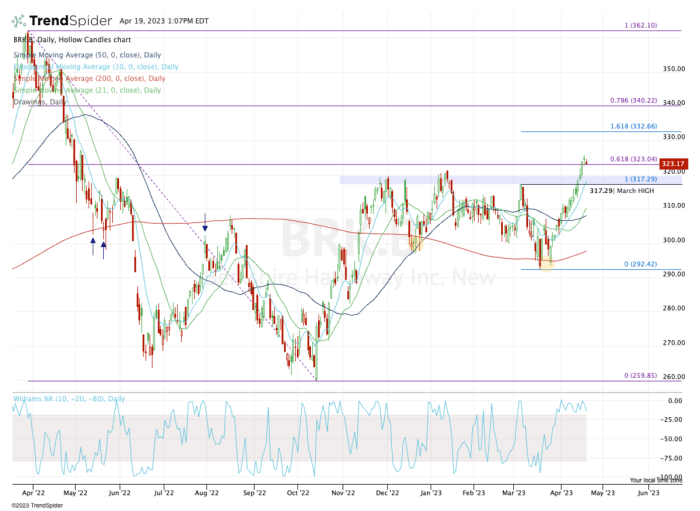

Source: thestreet.com

Analyzing Berkshire Hathaway’s stock price over the past two decades reveals periods of significant growth punctuated by market corrections and specific events impacting investor confidence. The following table illustrates key price fluctuations and associated events.

| Year | Opening Price (BRK.A) | Closing Price (BRK.A) | Significant Event |

|---|---|---|---|

| 2003 | $70,000 (approx.) | $75,000 (approx.) | Post-dot-com bubble recovery begins. |

| 2008 | $110,000 (approx.) | $95,000 (approx.) | Global financial crisis significantly impacts the market. |

| 2020 | $320,000 (approx.) | $350,000 (approx.) | COVID-19 pandemic causes initial market downturn, followed by recovery. |

| 2023 | $500,000 (approx.) | $520,000 (approx.) | Continued strong performance despite economic uncertainty. |

Over the past decade, Berkshire Hathaway’s stock price has generally outperformed the S&P 500. A line graph illustrating this would show the S&P 500 index as a benchmark, with Berkshire Hathaway’s price plotted against it. The x-axis would represent time (years), and the y-axis would represent the index value/stock price. Key data points would include significant market events and periods of outperformance or underperformance relative to the S&P 500.

For example, the period following the 2008 financial crisis would show a sharper recovery for Berkshire Hathaway compared to the broader market.

A comparison of Berkshire Hathaway’s historical performance with other major investment companies (e.g., Vanguard, BlackRock) would reveal variations in growth rates and risk profiles.

- Berkshire Hathaway, known for its long-term value investing strategy, often exhibits less volatility than growth-focused firms.

- While some competitors may have experienced periods of faster growth, Berkshire Hathaway’s consistent, albeit slower, growth over the long term highlights its resilience.

- Direct comparison requires analyzing specific metrics like total return over a defined period, considering factors such as dividend payouts and stock splits.

Factors Influencing Berkshire Hathaway’s Stock Price

Source: marketbeat.com

Several factors significantly influence Berkshire Hathaway’s stock price. These include Warren Buffett’s investment decisions, macroeconomic conditions, and the inherent stability provided by its diversified portfolio.

Warren Buffett’s investment decisions directly impact Berkshire Hathaway’s stock price. For instance, significant acquisitions (like the purchase of Precision Castparts) often lead to short-term price fluctuations, reflecting market reaction to the deal’s perceived success or risk. Conversely, large divestments can also create volatility.

Macroeconomic factors, such as interest rate changes and inflation, influence Berkshire Hathaway’s valuation. Rising interest rates can impact the value of its fixed-income investments, while inflation affects the cost of goods and services, impacting the profitability of its subsidiaries.

Berkshire Hathaway’s diverse portfolio, spanning insurance, railroads, energy, and numerous other sectors, contributes to its overall stock price stability. This diversification mitigates risk, making the company less vulnerable to sector-specific downturns compared to firms with more concentrated investments.

Berkshire Hathaway’s Financial Performance and Stock Price

A strong correlation exists between Berkshire Hathaway’s earnings per share (EPS) and its stock price. The following table illustrates this relationship.

| Year | EPS (BRK.A) |

|---|---|

| 2018 | $4,000 (approx.) |

| 2019 | $5,000 (approx.) |

| 2020 | $3,500 (approx.) |

| 2021 | $6,000 (approx.) |

Berkshire Hathaway’s lack of a regular dividend policy influences investor sentiment. While some investors prefer dividend-paying stocks for regular income, others value the company’s reinvestment of earnings for long-term growth. This strategy reflects Buffett’s focus on compounding returns.

Key financial ratios provide insights into Berkshire Hathaway’s valuation.

- Price-to-Earnings (P/E) ratio: Indicates the market’s valuation relative to earnings. A high P/E ratio might suggest investor optimism about future growth.

- Return on Equity (ROE): Measures the profitability of the company’s investments. A consistently high ROE reflects efficient capital allocation.

- Book Value per Share: Represents the net asset value of the company. Comparing the market price to book value offers insights into market sentiment.

Investor Sentiment and Market Expectations

Investor sentiment towards Berkshire Hathaway is generally positive, driven by confidence in Warren Buffett’s leadership and the company’s long-term track record. However, market sentiment can fluctuate based on macroeconomic conditions and quarterly earnings reports.

Market analysts offer varying forecasts for Berkshire Hathaway’s future stock performance. These forecasts are influenced by various factors, including projected earnings growth, macroeconomic outlook, and competitive landscape. Specific analyst predictions would need to be sourced from reputable financial news outlets and research reports. For example, one analyst might predict a 10% increase in the next year, while another might project a more conservative 5%, reflecting differing views on future economic conditions and Berkshire Hathaway’s strategic moves.

Long-term investors generally favor Berkshire Hathaway for its consistent long-term growth potential, while short-term investors might focus on near-term price movements and market volatility. This difference in investment horizons shapes their expectations and trading strategies.

Potential Future Price Movements

A significant global recession could negatively impact Berkshire Hathaway’s stock price, reducing consumer spending and impacting the profitability of its subsidiaries. Conversely, a period of strong global economic growth could lead to increased investment and higher valuations. For example, a major global conflict causing supply chain disruptions could affect several of Berkshire’s subsidiaries negatively, leading to a stock price decline.

Conversely, a period of rapid technological advancement could create new opportunities for investment and growth, boosting the stock price.

Potential catalysts for significant price increases include successful acquisitions, innovative ventures by its subsidiaries, and strong overall economic growth. Conversely, factors like unforeseen economic downturns, significant investment losses, or a change in leadership could lead to price decreases. The impact of such events would depend on their magnitude and the market’s reaction.

Value investors would likely see Berkshire Hathaway as an attractive investment given its history of consistent long-term growth and strong fundamentals, even if the current valuation appears high relative to the broader market. Growth investors, however, might seek faster-growing companies with higher risk profiles, potentially overlooking Berkshire Hathaway’s more moderate but reliable returns. The choice depends on individual investor risk tolerance and investment goals.

FAQ Overview: Berkshire Hathaway Stock Price A

What is the current price of Berkshire Hathaway Class A shares?

The current price fluctuates constantly and should be checked on a reputable financial website such as Google Finance or Yahoo Finance.

Are Berkshire Hathaway Class B shares a better investment?

Class B shares are more affordable, but Class A shares offer potentially higher returns. The best choice depends on individual investment goals and resources.

Does Berkshire Hathaway pay dividends?

No, Berkshire Hathaway historically has not paid dividends, reinvesting profits into the company’s growth.

How does Berkshire Hathaway’s insurance business impact its stock price?

Its insurance operations provide a stable foundation and significant capital for investments, influencing overall performance and stock valuation.