Understanding Boeing (BA) Premarket Stock Price Movement

Ba premarket stock price – The premarket trading session for Boeing (BA) stock, like other publicly traded companies, offers a glimpse into investor sentiment and potential market movements before the regular trading day begins. Analyzing these premarket fluctuations can provide valuable insights, but requires a nuanced understanding of the factors at play.

Factors Influencing BA’s Premarket Price Fluctuations

Several factors contribute to the volatility of BA’s premarket price. These include news releases (earnings reports, contract wins/losses, regulatory announcements), analyst ratings and price target changes, overall market sentiment (influenced by broader economic indicators or geopolitical events), and overnight trading activity in global markets. Unexpected events, such as natural disasters or significant geopolitical shifts, can also dramatically affect premarket pricing.

Typical Trading Volume During BA’s Premarket Session

Premarket trading volume for BA is generally lower compared to regular trading hours. This is because fewer investors actively participate during this period. However, significant news or events can drive higher premarket volume, indicating increased investor interest and potentially amplified price swings.

Comparison of BA’s Premarket and Regular Trading Hours Price Behavior

BA’s premarket price movements often, but not always, correlate with its regular trading hours performance. While premarket action can offer a preview of potential daily trends, it’s crucial to remember that the premarket is a less liquid market, and prices can be significantly influenced by limited trading activity and potentially less reliable information flow. Therefore, premarket price movements should be considered as an indicator, not a definitive predictor, of the day’s price direction.

Examples of News Events Impacting BA’s Premarket Price

Examples of news events that significantly impacted BA’s premarket price include the announcement of major aircraft orders or cancellations, reports on production delays or quality control issues, and updates on the company’s financial performance (especially earnings reports). Positive news tends to lead to premarket price increases, while negative news often results in decreases.

Correlation Between Premarket Price Changes and Subsequent Daily Price Movements

| Premarket Price Change | Subsequent Daily Price Change (Example) | Frequency (Example) | Notes |

|---|---|---|---|

| Up > 2% | Up 1-3% | 60% | Strong positive correlation |

| Down > 2% | Down 1-3% | 70% | Strong negative correlation |

| Between -1% and +1% | Mixed | 30% | Weak correlation |

| No Change | Mixed | 40% | Weak correlation |

Premarket Data Sources for BA Stock

Reliable real-time data is essential for informed premarket trading decisions. Several sources provide this information, each with its strengths and limitations.

Reliable Sources for Real-Time BA Premarket Stock Price Data

Major financial data providers such as Bloomberg Terminal, Refinitiv Eikon, and TradingView offer real-time premarket data. Many brokerage platforms also integrate premarket data feeds into their trading interfaces. Free sources, such as Google Finance or Yahoo Finance, provide delayed premarket data, which may not be suitable for active trading.

Differences in Data Accuracy Between Various Sources

The accuracy of premarket data can vary depending on the source. Real-time data providers generally offer higher accuracy, while free or delayed data sources might have some lag. Discrepancies can arise due to differences in data aggregation methods and the speed of information dissemination across various platforms.

Potential Biases or Delays in Premarket Data, Ba premarket stock price

Biases can be introduced through selective reporting or the prioritization of specific data points. Delays can occur due to technical issues, data transmission bottlenecks, or the inherent time lag in information processing. It’s essential to be aware of these potential limitations when using premarket data.

Reputable Financial News Websites Reporting on BA’s Premarket Activity

Major financial news outlets such as the Wall Street Journal, Bloomberg, Reuters, and CNBC regularly report on premarket activity for BA and other major stocks. These reports often incorporate analysis and commentary that can provide context for interpreting premarket price movements.

Comparison of Premarket Data Platforms

| Platform | Features | Limitations | Cost |

|---|---|---|---|

| Bloomberg Terminal | Real-time data, advanced charting tools, news feeds | Expensive subscription | High |

| Refinitiv Eikon | Real-time data, analytics tools, news and research | Expensive subscription | High |

| TradingView | Real-time and historical data, charting tools, social sentiment analysis | Free version has limitations | Free/Paid |

| Google Finance | Delayed data, basic charting | Limited features, delayed data | Free |

Interpreting BA’s Premarket Price Signals: Ba Premarket Stock Price

Understanding the implications of premarket price movements requires careful consideration of various factors and the avoidance of overreliance on this data alone.

Implications of Significant Price Increases or Decreases During BA’s Premarket

A significant premarket price increase could signal positive investor sentiment driven by positive news or overall market optimism. Conversely, a significant decrease might reflect negative sentiment due to negative news or broader market concerns. However, these are just potential indicators and not guaranteed predictors of the day’s price movement.

Interpreting Premarket Price Movements with Other Market Indicators

Premarket data should be analyzed in conjunction with other market indicators such as trading volume, overall market index performance (e.g., the Dow Jones Industrial Average or S&P 500), and relevant sector-specific indices. This holistic approach provides a more comprehensive understanding of the forces influencing BA’s price.

Potential Risks of Relying Solely on Premarket Price Information

Source: thecoinrepublic.com

Relying solely on premarket price information for trading decisions is risky. The premarket is less liquid, and price movements can be influenced by factors that may not persist throughout the regular trading session. It’s crucial to incorporate other analytical tools and risk management strategies.

Scenarios Where Premarket Movements May Not Accurately Predict Daily Trading Direction

Premarket price movements might not accurately predict the day’s trading direction due to factors such as news releases during regular trading hours, unexpected events, or changes in overall market sentiment. The limited liquidity and participation in the premarket can lead to exaggerated price swings that don’t reflect the broader market’s long-term view.

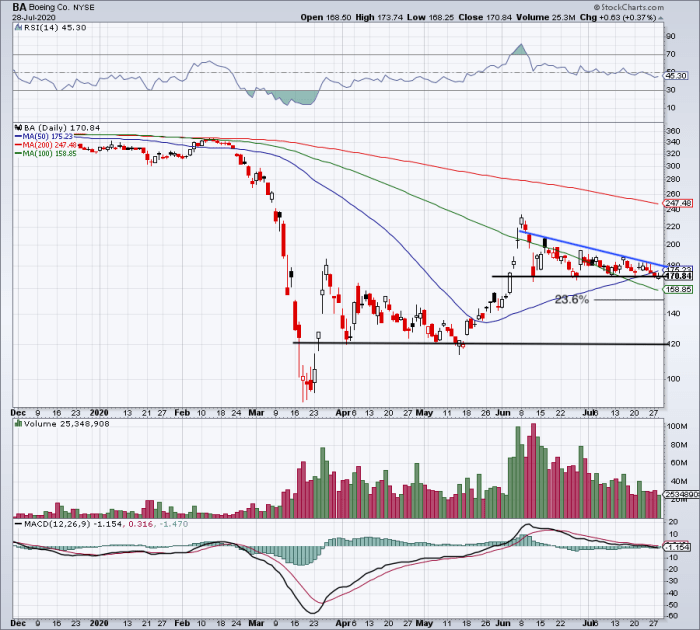

Using Premarket Data with Technical Analysis Tools

Combining premarket data with technical analysis tools, such as moving averages, relative strength index (RSI), and candlestick patterns, can enhance decision-making. Technical analysis can help identify potential support and resistance levels, trends, and momentum, providing additional context to the premarket price information.

BA Premarket Price and Investor Sentiment

Source: investorplace.com

BA’s premarket price often reflects the prevailing investor sentiment. Understanding these dynamics is crucial for interpreting price movements.

Indicators of Investor Sentiment Reflected in BA’s Premarket Price

A rising premarket price often suggests positive investor sentiment, while a falling price indicates negative sentiment. High trading volume during the premarket can amplify the signal, indicating strong conviction in the price direction. Conversely, low volume might suggest uncertainty or indecision.

Influence of News Releases and Social Media Trends

News releases, especially earnings reports and significant contract announcements, directly influence premarket pricing. Social media trends can also contribute, although their impact is often less predictable and may be more reflective of short-term sentiment shifts rather than fundamental changes.

Comparison of Premarket Investor Sentiment Towards BA with Competitors

Comparing BA’s premarket performance and investor sentiment with its competitors within the aerospace and defense industry can provide valuable context. A stronger premarket performance relative to competitors might suggest that investors are more optimistic about BA’s prospects.

Gauging Market Expectations Based on BA’s Premarket Price Action

Market expectations can be gauged by observing how BA’s premarket price reacts to news events and overall market conditions. A strong positive reaction to good news, for example, indicates a generally positive market outlook for the company.

Timeline Showing How Significant News Events Impacted Investor Sentiment and Premarket Pricing

- Q4 2022 Earnings Release: Positive surprise, strong premarket price increase.

- Major Aircraft Order Announcement (Example): Significant premarket price jump reflecting positive investor response.

- Supply Chain Disruption Report (Example): Negative premarket price movement indicating investor concern.

- Geopolitical Event Impacting Global Trade (Example): Premarket price decline reflecting uncertainty in the market.

Visualizing BA’s Premarket Price Trends

Visual representations of BA’s premarket price data can enhance understanding of trends and patterns.

Graph Illustrating BA’s Premarket Price Over a Specified Period

A line graph depicting BA’s premarket price over, for example, the last three months, would show the overall price trend. Key trends and patterns, such as upward or downward price movements, periods of consolidation, and significant price spikes, would be easily visible. The graph could also incorporate volume data to identify periods of high or low investor activity.

Chart Depicting the Relationship Between BA’s Premarket Volume and Price Changes

A scatter plot could illustrate the relationship between BA’s premarket volume and price changes. This visualization would help determine if high volume is associated with larger price swings and whether there is a consistent correlation between volume and price direction.

Visual Representation Showing the Correlation Between BA’s Premarket Price and the Overall Market Index

A comparison chart showing BA’s premarket price alongside a relevant market index (e.g., the Dow Jones Industrial Average or S&P 500) would illustrate the relationship between BA’s premarket performance and the broader market. This visualization helps determine whether BA’s premarket movements are driven by company-specific factors or broader market trends.

Interpreting Candlestick Patterns Observed in BA’s Premarket Trading Activity

- Bullish Engulfing Pattern: A large green candlestick engulfing a preceding red candlestick can signal a potential bullish reversal.

- Bearish Engulfing Pattern: A large red candlestick engulfing a preceding green candlestick can indicate a potential bearish reversal.

- Hammer: A small body candlestick with a long lower shadow suggests a potential bullish reversal.

- Hanging Man: A small body candlestick with a long lower shadow at the top of an uptrend suggests a potential bearish reversal.

FAQ

What time does BA’s premarket trading typically begin and end?

Premarket trading hours for BA, like most US-listed stocks, generally start around 4:00 AM ET and end at 9:30 AM ET, coinciding with the start of regular market hours.

How liquid is BA’s premarket trading compared to regular market hours?

Premarket trading volume for BA is typically lower than during regular trading hours. Liquidity can be more limited, leading to potentially wider price swings.

Are there any specific regulations governing premarket trading?

Premarket trading is subject to the same SEC regulations as regular market trading. Market manipulation and insider trading are strictly prohibited.

How can I access historical premarket data for BA?

Many financial data providers, including those mentioned in the guide, offer historical premarket data, often as part of a subscription service.